China Fuel Cell Market, (By Material: PEMFC, PAFC, SOFC, MCFC & Others By Application: Stationary, Transportation, Portable & Others. By Region - China) - Industry Analysis, Growth, Trends & Forecast, 2022 to 2032

Report Type : Syndicate Report

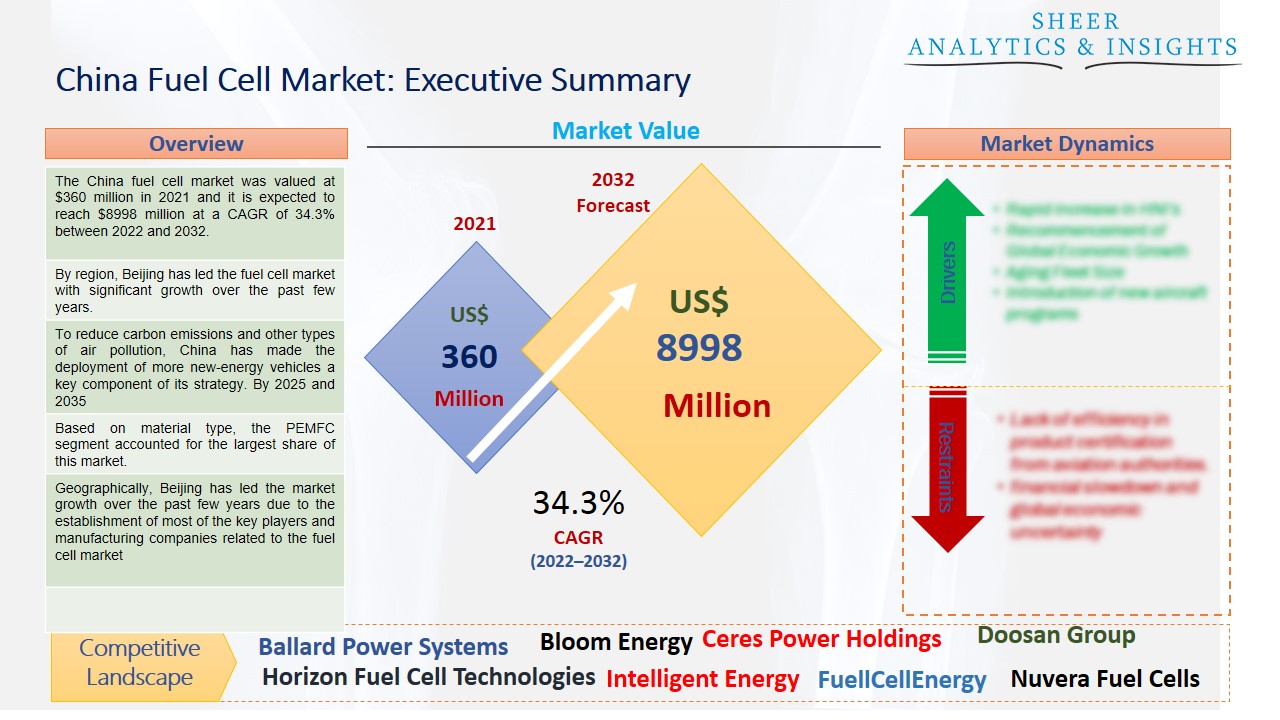

The China fuel cell market was valued at $360 million in 2021 and it is expected to reach $8998 million at a CAGR of 34.3% between 2022 and 2032. The main drivers of market expansion are the rising demand for clean power generation with low or no emissions. The need for fuel cells will also increase due to numerous laws and regulations on carbon emissions soon.

By region, Beijing has led the fuel cell market with significant growth over the past few years.

Every fuel cell is made up of two electrodes that are encircled by an electrolyte: a negative electrode, or anode, and a positive electrode, or cathode. Fuel is fed to the anode of this configuration, and oxygen is fed to the cathode. An extremely sophisticated, pollution-free method of producing electricity is the fuel cell. Fuel cells, which can generate power as long as a fuel supply is available and offer up to three times higher efficiency than combustion technologies, differ from batteries in that they can do so. China, the world's largest producer of goods, lags behind industrialized nations like the United States, Japan, and Korea in the development and use of fuel cells.

Source: SAI Research

Download Free PDF Sample Request

The increased demand for clean power generation with low or no emissions is one of the primary factors driving market expansion. Shortly, there will be several laws and regulations on carbon emissions, which will boost the need for fuel cells. The Paris Agreement and the cooperation of political leaders from around the world in lowering their nations' carbon footprints have given green and renewable technology a boost in the marketplace. Additionally, the integration of fuel cells in electric vehicles, which dominate the market in China, is a major driver in the country's fuel cell industry. Electric vehicles are one of the most potential areas for the future growth of the fuel cell market.

To reduce carbon emissions and other types of air pollution, China has made the deployment of more new-energy vehicles a key component of its strategy. By 2025 and 2035, it is intended to grow FCV ownership to 100,000 and one million vehicles, respectively. The bulk of Chinese fuel cell manufacturers focus on creating proton exchange membrane fuel cells, which entails integrating fuel cells into multiple modes of transportation. As a result, China is also expected to see considerable growth in the fuel cell industry.

Based on material type, the PEMFC segment accounted for the largest share of this market. PEMFCs benefit from quick startup, fuel input flexibility, small design, lightweight, low cost, and electrolyte firmness. Formic acid, methanol, and pure hydrogen are all acceptable inputs. The proton exchange membrane fuel cell is the only type of fuel cell that is commercially available in China (PEMFC). This is best suited for portable applications, including road transportation, and employs pre-isolated hydrogen. The use of other fuel cell types is largely restricted to government and academic research labs.

In terms of application type, the transportation category is the largest segment in China. As the government increasingly concentrates on ways to use sustainable energy technologies to transition to a low-carbon economy, China has significant potential in the fuel cell sector. The transition of the automobile sector towards clean and environmentally friendly fuel technology is one of the primary trends that are fueling the growth of the fuel cell market. With the adoption of electric cars and fuel cell technology, automakers are now discovering new opportunities for environmentally friendly transportation. On the other hand, the stationary segment is also expected to become the second-largest category in the future.

Geographically, Beijing has led the market growth over the past few years due to the establishment of most of the key players and manufacturing companies related to the fuel cell market. Moreover, Compared to other regions, China has the largest automotive market in the world, which promotes the quick development of technology like fuel cell cars. Later, funding for fuel cell research and development in institutions in Dalian, Wuhan, Shanghai, and Beijing was made available through the program. Hence, these rising factors are expected to accelerate the growth of the fuel cell market in China over the forecast period from 2022 to 2032.

According to the study, key players such as Ballard Power Systems (Canada), Bloom Energy (U.S), Ceres Power Holdings (U.K), Doosan Group (U.S), Horizon Fuel Cell Technologies (Singapore), Intelligent Energy (U.S), FuellCellEnergy Inc (U.S), Nedstack Fuel Cell Technology (Netherlands), Nuvera Fuel Cells (U.K), Plug Power (U.S), SFC (U.S), Toshiba Fuel Cell Power Systems (Japan), among others are leading the China fuel cell market.

Scope of the Report:

| Report Coverage | Details |

| Market Size in 2021 | US$ 360 Million |

| Market Volume Projection by 2032 | US$ 8998 Million |

| Forecast Period 2022 to 2032 CAGR | 34.3% |

| Base Year: | 2021 |

| Historical Data | 2019, 2020 and 2021 |

| Forecast Period | 2022 to 2032 |

| Segments covered |

By Material Type: PEMFC, PAFC, SOFC, MCFC & Others By Application Type: Stationary, Transportation, Portable & Others |

| Geographies covered |

China |

| Companies covered | Ballard Power Systems (Canada), Bloom Energy (U.S), Ceres Power Holdings (U.K), Doosan Group (U.S), Horizon Fuel Cell Technologies (Singapore), Intelligent Energy (U.S), FuellCellEnergy Inc (U.S), Nedstack Fuel Cell Technology (Netherlands), Nuvera Fuel Cells (U.K), Plug Power (U.S), SFC (U.S), Toshiba Fuel Cell Power Systems (Japan), among others |

The China Fuel Cell Market Has Been Segmented Into:

The China Fuel Cell Market – by Material Type:

- PEMFC

- PAFC

- SOFC

- MCFC

- Others

The China Fuel Cell Market – by Application Type:

- Stationary

- Transportation

- Portable

- Others

The China Fuel Cell Market – by Regions:

- Beijing

- Shanghai

- Guangzhou

- Sichuan

- Others

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing