China Yogurt Market, (By Type - Flavored, Non-Flavored. By Fat Content - Regular, Fat-Free, Low-Fat. By Form - Set Yogurt, Free Yogurt, Greek Yogurt, Drinkable Yogurt, Frozen Yogurt, Others. By City Type - Tier 1, Tier 2 & Tier and below. By Distribution Channel - Supermarket, Hypermarket, Independent Groceries, Small Market, Convenience Stores, Others. By Geography - China) - Market insights, analysis, trends, and forecast 2022-2032

Report Type : Syndicate Report

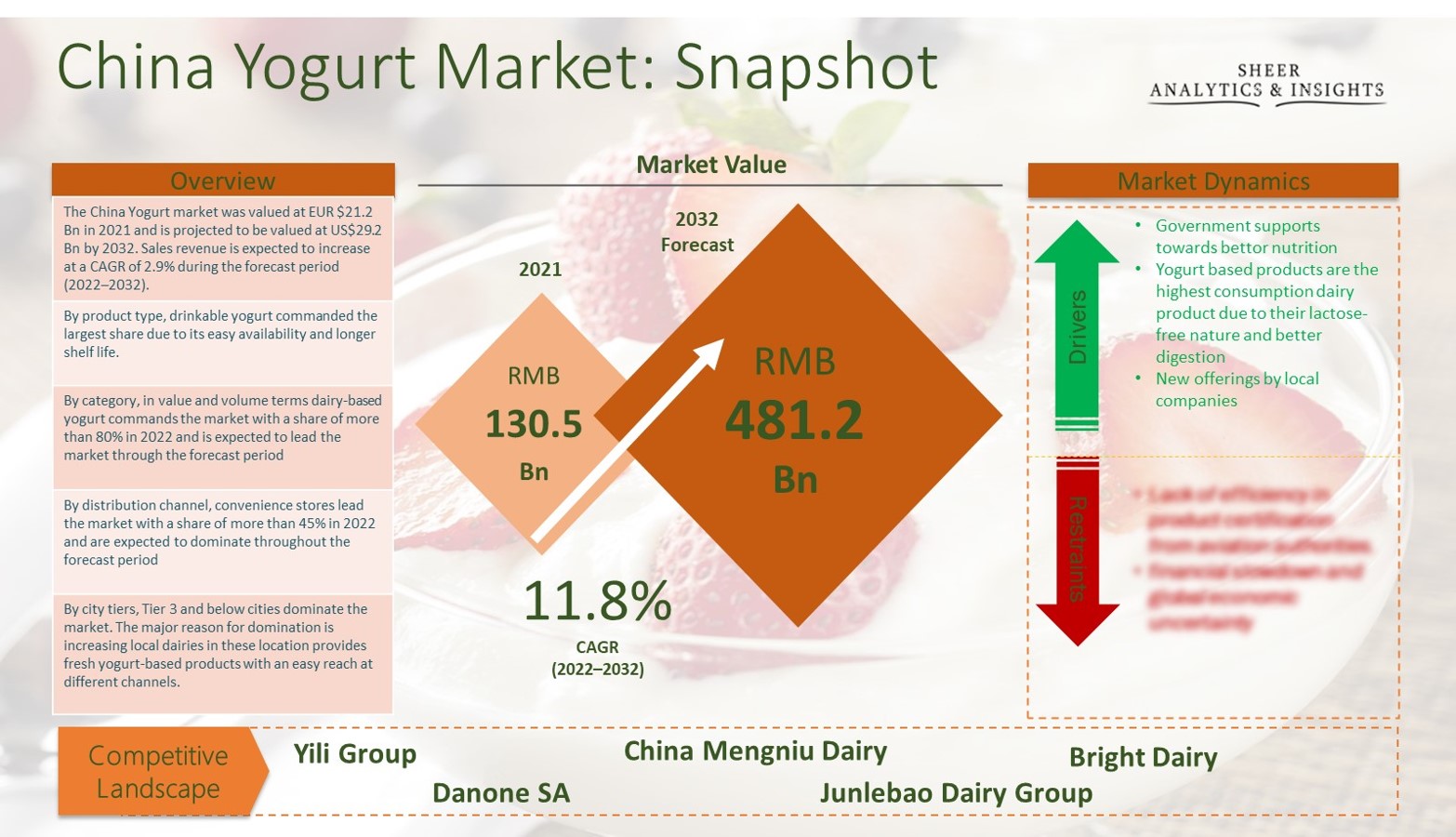

China yogurt market was valued RMB 130.5 billion in 2021 and it is expected to reach RMB 481.2 billion at the CAGR of 11.8% during the forecast period between 2022 and 2032. The yogurt market in China is differentiated mainly into two products, such as flavored and non-flavored. In 2020, the country held more than 80% share across the Asian region. This research report provides you with China’s industrial market trend, competitive atmosphere, new product launches, and other segmentations.

In Asia, China is holding the maximum market share for the last few years in producing yogurt.

Source: SAI Research

Yogurt is a type of food that is made from the bacterial fermentation of milk. It can be divided into dairy and non-dairy yogurt. Chinese population has been suffering from several diseases such as diabetes, bad cholesterol, obesity, digestive problems, high blood pressure, and weight gaining issues. These health issues have further supported the market growth in China by providing dietary food product such as yogurt to consumers who are health conscious. Most of the people from China are lactose-intolerant. In present days, they are sensitive about choosing best yogurt product such as organic yogurt for the benefit of their family’s health. However, using different color of flavor implementation is found allergic to some consumers. These inflammation issues could restrain the market growth. However, regular use of yogurt product is expected to dominate the market during the forecast period across the country. In China, supermarkets as a distributional channel will get benefited from the consumers over the upcoming years. This is because of the interference of many brands, companies and their immense supply of yogurt products all over the country.

In present times, China’s dairy product consumption is focusing only on milk products. However, consumption of yogurt is also rapidly increasing with an annual growth of more than 30%. Some type of fruit yogurt is making a profit of 40% annually in the China yogurt market. China’s distributional channel is divided into independent small grocers, supermarket/hypermarkets, online stores, and convenience stores. Moreover, these convenience stores held most of the share of 47.8% in yogurt market. However, the online store channel is going to be the largest distributional segment during the upcoming forecast period between 2022 and 2032. However, the government of China is encouraging their yogurt industries to make efforts and improve themselves to be more competitive in the global market. The government aims to provide guidance for dairy farms to operate better and superior R&D in China. Digestive disorders among Chinese population benefitted the demand for yogurt across the various consumer groups in China. For example, drinkable yogurt is the most preferred probiotic food. It can be found in different flavors. However, the inclination of Chinese consumers towards the digestive health oriented food has driven the yogurt market across the country. Therefore, this has led the yogurt market to hold a remarkable share in China. The on-going trend of healthy dietary options among the Chinese consumers is another major factor which is driving the sales of yogurt products across the country.

Competition between several companies is gradually increasing. At present, Mengniu Company is a leading key player and it is dominating the China yogurt market. The company has become the maximum shareholder in producing yogurt. Danone’s Dairy Product has been achieved growth with the partnership of Junlebao. Their market share is growing by producing new yogurt products that can be stored at a different room temperature. Yili Industrial Group Company is also capturing most of the market share in yogurt production across the country.

Leading companies in China yogurt market are Junlebao Dairy Group, China Mengniu Dairy, Danone SA, Bright Dairy, Chobani LLC, Yili Group and others. Apart from these companies, several international industrial players such as Nestle China Ltd., Kowloon Dairy Limited are also the leading players in China yogurt market. These industries are producing traditional dairy and non-dairy products for the taste Chinese consumers including both adults and children. There are other companies which are leading the China yogurt market. These companies are Fujian Haocaitou Food, Huaxia Dairy Farm, Beijing Sanyuan Food, and Xinjiang Tianrun Dairy among others.

Scope of the Report:

|

Report Coverage |

Details |

||

|

Base Year: |

2021 |

Market Size in 2021: |

130.5 Billion RMB |

|

Historical Data for: |

2019, 2020 and 2021 |

Forecast Period: |

2022 to 2032 |

|

Forecast Period 2022 to 2032 CAGR: |

11.8% |

2032 Value Projection: |

481.2 Billion RMB |

|

Segments covered: |

By Type - Flavored, Non-Flavored. By Fat Content - Regular, Fat-Free, Low-Fat. By Form - Set Yogurt, Free Yogurt, Greek Yogurt, Drinkable Yogurt, Frozen Yogurt, Others. By City Type - Tier 1, Tier 2 & Tier and below. By Distribution Channel - Supermarket, Hypermarket, Independent Groceries, Small Market, Convenience Stores, Others. |

||

|

Geographies covered: |

China |

||

|

Companies covered: |

Junlebao Dairy Group, China Mengniu Dairy, Danone SA, Bright Dairy, Chobani LLC, Yili Group |

||

The China Yogurt Market Has Been Segmented Into:

China Yogurt Market – by Type:

- Flavored

- Non-Flavored

China Yogurt Market – by Fat Content:

- Regular

- Fat-Free

- Low-Fat

China Yogurt Market – by Form:

- Set Yogurt

- Free Yogurt

- Greek Yogurt

- Drinkable Yogurt

- Frozen Yogurt

- Others

China Yogurt Market – by Form:

- Tier 1

- Tier 2

- Tier 3 and below

China Yogurt Market – by Distribution Channel:

- Supermarket

- Hypermarket

- Independent Groceries

- Small Market

- Convenience Stores

- Others

China Yogurt Market - By Geography

- China

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing