Europe Electric Vehicle Market, (By Product Type: BEV, PHEV & Others. By Vehicle Type: Passenger Cars, Commercial Vehicles & Others. By Region - Europe) - Industry Analysis, Growth, Trends & Forecast, 2022 to 2032

Report Type : Syndicate Report

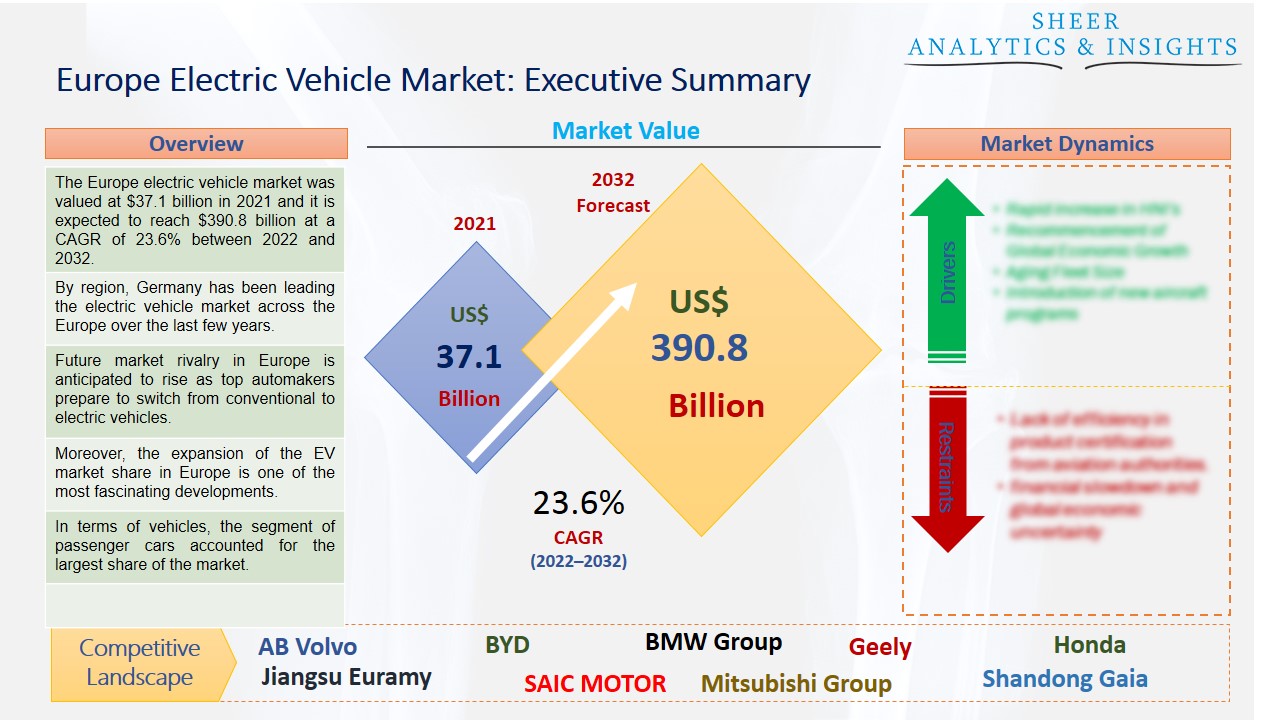

The Europe electric vehicle market was valued at $37.1 billion in 2021 and it is expected to reach $390.8 billion at a CAGR of 23.6% between 2022 and 2032. In contrast to other important EV markets, Europe has experienced rapid EV growth. Sales of EVs could be boosted by the new emissions standard for passenger cars in the European Union, which is 95 grams of carbon dioxide per kilometer. Smaller markets like Estonia, Iceland, and Slovakia saw a drop in sales overall. Nearly 5% of the rise in the European EV market was attributable to sales of EVs in Germany and the Netherlands.

By region, Germany has been leading the electric vehicle market across the Europe over the last few years.

Instead of a typical transmission unit powered only by an internal combustion engine, electric vehicle propulsion is provided by one or two electric traction motors. To run the traction motor and move the vehicle forward, traction motors are either powered by rechargeable battery packs or by an internal combustion engine that also charges the car's battery pack. Hybrid electric vehicles are those that fit this description. Furthermore, the requirement for manufacturers to adhere to stricter European Union CO2 rules for new passenger cars and vans starting in January 2020 was a major driver of EV growth in Europe. The influence of national and municipal policies, as well as other elements, like the availability of electric models and charging infrastructure across local markets, was evident in the large difference seen across the European market. This comparatively high local uptake of EVs may provide insights for future local EV policy and program creation, adoption, and maintenance. Northern European regions continued to experience the highest uptake. In Norway, the Netherlands, and Sweden, there were 16 metropolitan areas with EV shares that were double the norm for Europe (23%).

Source: SAI Research

Download Free PDF Sample Request

Future market rivalry in Europe is anticipated to rise as top automakers prepare to switch from conventional to electric vehicles. Government laws that prohibit the use of fossil fuels in highly polluted areas are motivating automakers to switch to electric vehicles. The sale of electric vehicles has surged exponentially in recent years, along with their better range, expanded model selection, and improved performance. Electric vehicles are not, however, a universal phenomenon yet. Due to increased purchasing costs and a lack of charging infrastructure, sales have lagged in developing and growing nations. But it's not just about energy density. Another top objective for EV innovation is lowering the requirement for essential metals. The market share of lithium iron phosphate (LFP) cathodes, which don't need nickel or cobalt, has doubled over the previous year. This was made possible in part by cutting down on pack dead weight with the help of cutting-edge cell-to-pack technologies, but primarily as a result of automakers switching to LFP to lessen their exposure to commodity price volatility.

Moreover, the expansion of the EV market share in Europe is one of the most fascinating developments. Rapid expansion spans the continent as opposed to occurring only in 3 or 4 nations. Naturally, a big part of this is attributable to the EU's mandate that automakers reduce the CO2 emissions of the vehicles they sell or face hefty fines.

Based on product type, the BEV segment is expected to propel the market growth due to its rising demand among a large number of automotive industries across several nations of Europe. The EU market is slowly being penetrated by battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). The number of new electric car registrations each year has been steadily rising.

In terms of vehicles, the segment of passenger cars accounted for the largest share of the market. The sales of passenger electric cars have increased over the last few years due to rising demand among a large number of consumers. The need for manufacturers to meet more severe European Union CO2 standards for new passenger cars and vans during the past few years was a major factor in the emergence of EVs in Europe. There was a lot of diversity in the European market, which was a reflection of the impact of national and municipal policies as well as other variables like the accessibility of electric models and the availability of charging stations in different local markets.

Geographically, Germany has led the market with significant growth and is also expected to hold its dominant position across the European market in the future. In advance of national goals to stop new combustion vehicle sales or registrations, an increasing number of municipal governments are proposing plans to control or restrict access to combustion engine vehicles in urban centers, cities, or metropolitan areas. After China, Germany is the largest single market for electric vehicles worldwide. On the other side, Sweden and Italy are also projected to accelerate market growth during the forecast period. Additionally, expanding public desire in purchasing electric cars over conventional diesel-powered cars and growing government backing for increasing electric car sales nationwide are the factors ascribed to the strong growth of these countries.

According to the study, key players such as AB Volvo (Sweden), BMW Group (Germany), BYD (China), Goldstone Infratech Ltd (India), Groupe Relaunt (Japan), Geely (China), Hyundai (South Korea), Honda (Japan), Jiangsu Euramy (China), Mahindra Group (India), Mitsubishi Group (Japan), Mercedes-Benz Group (Germany), Porsche SE (Germany), Qingdao Sincerely (China), Stellantis (Italy), Shandong Gaia (China), SAIC MOTOR (China), The Hero Group (India), Tata Group (India), Toyota Group (Japan), Tesla Inc (U.S), Yamaha (Japan), among others are leading the Europe electric vehicle market.

Scope of the Report:

| Report Coverage | Details |

| Market Size in 2021 | US$ 37.1 Billion |

| Market Volume Projection by 2032 | US$ 390.8 Billion |

| Forecast Period 2022 to 2032 CAGR | 23.6% |

| Base Year: | 2021 |

| Historical Data | 2019, 2020 and 2021 |

| Forecast Period | 2022 to 2032 |

| Segments covered |

By Product Type: BEV, PHEV & Others By Vehicle Type: Passenger Cars, Commercial Vehicles & Others |

| Geographies covered |

Europe |

| Companies covered | AB Volvo (Sweden), BMW Group (Germany), BYD (China), Goldstone Infratech Ltd (India), Groupe Relaunt (Japan), Geely (China), Hyundai (South Korea), Honda (Japan), Jiangsu Euramy (China), Mahindra Group (India), Mitsubishi Group (Japan), Mercedes-Benz Group (Germany), Porsche SE (Germany), Qingdao Sincerely (China), Stellantis (Italy), Shandong Gaia (China), SAIC MOTOR (China), The Hero Group (India), Tata Group (India), Toyota Group (Japan), Tesla Inc (U.S), Yamaha (Japan), among others. |

The Europe Electric Vehicle Market Has Been Segmented Into:

The Europe Electric Vehicle Market – by Product Type:

- BEV

- PHEV

- Others

The Europe Electric Vehicle Market – by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- Others

The Europe Electric Vehicle Market – by Regions:

Europe

- Germany

- Norway

- Netherlands

- United Kingdom

- Sweden

- Italy

- Others

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing