Europe Yogurt Market, (By Products - Fresh yogurt, Drinkable yogurt (Fruit and Plain), Greek yogurt (Fruit and Plain), Coconut yogurt, Icelandic yogurt (Skyr) and others. By Age Group - 0-18, 18-24, 24-40, 40-60 and 60+ and Others. By Country - France, Germany, United Kingdom, Italy, Greek, Spain, Russia, and Rest of Europe Countries) - Market insights, analysis, trends, and forecast 2022-2032

Report Type : Syndicate Report

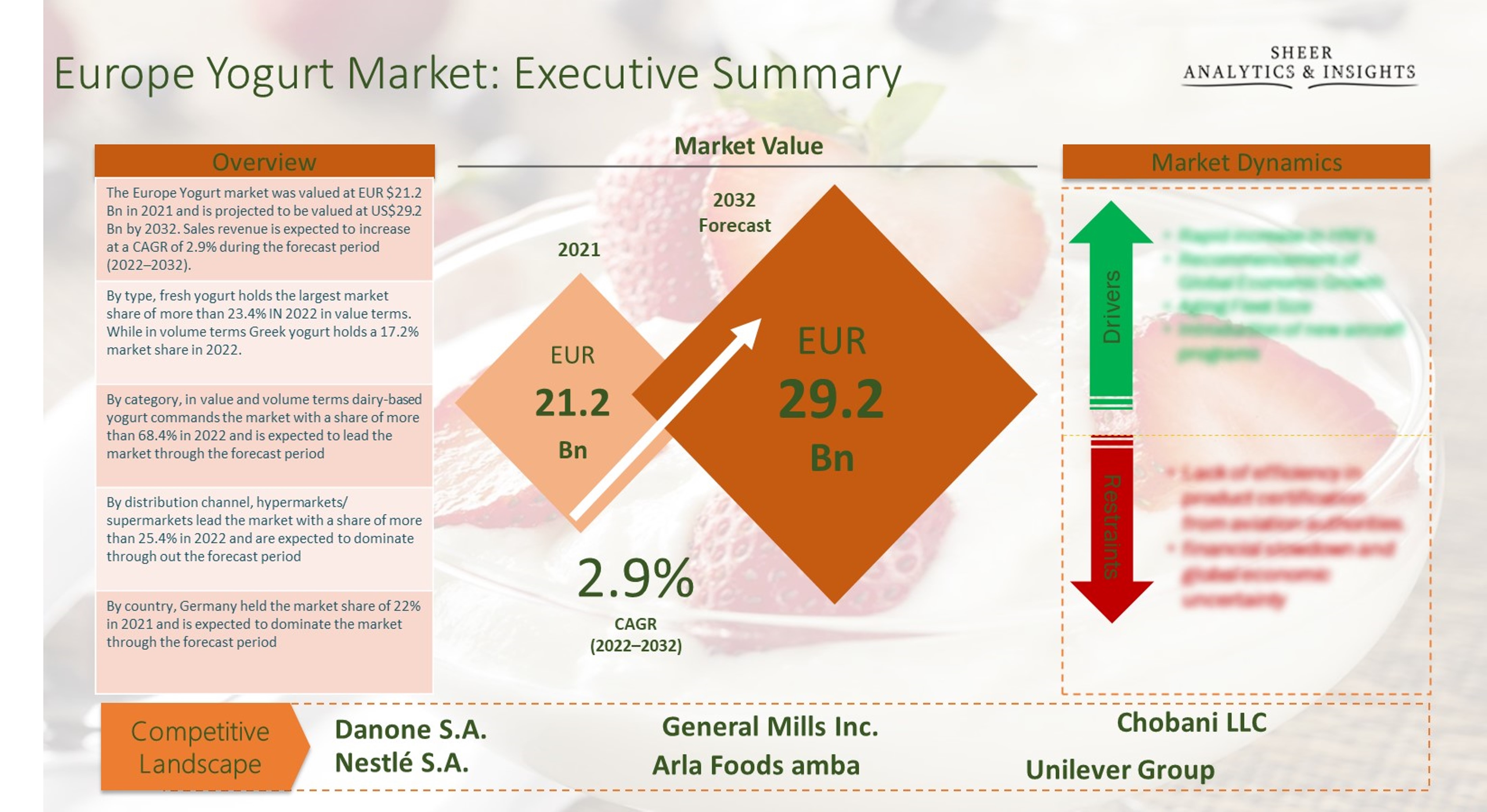

Europe Yogurt Market was valued at EUR 21.2 billion in 2021 and it is expected to reach EUR 29.2 billion by 2032 at a CAGR of 2.9% during the forecast period between 2022 and 2032. The annual production of yogurt in Europe is approximately 7.57 million tons. However, it is expected to reach 37 million tons consumption of yogurt over the forecast period from 2022 to 2032. Several diseases are expanding all over the Europe and consumers are becoming extra careful in choosing daily consumption for their health. However, there is no specific dose for diseases such as celiac. However, gluten-free food such as Greek yogurt can cure such diseases. Greek yogurt is becoming most popular across the region for its quality and benefits among the European consumers including children to adults.

In 2020, Germany held 22% share of total European production in the yogurt market.

Source; SAI Research

Yogurt is a type of food that is made from the bacterial fermentation of milk. It can be divided into dairy and non-dairy yogurt. Yogurt can be consumed to reduce diseases such as the risk of diabetes, bad cholesterol, obesity, digestive problems, high blood pressure, and weight gain issues. Therefore, rising awareness among the people is helping the European market to make a good profit by producing dietary food product such as yogurt. However, some diary manufacturing industries produce yogurt stuffed with sugar, which is bad for health. It could give side effects on the customers health. Eating yogurts added with artificial sugar can lead to diseases such as brain tumors and neurological illness. According to a report, published by Sheer Analytics and Insights, in Europe, about forty-three percent of the population consume yogurt as their daily breakfast food. Drinking yogurt is becoming popular among children. This new product demands three keys for consumers and these are health, mobility, and convenience. Greek yogurt is gluten-free and it can help consumers to lose weight. This type of yogurt assists with stomach medical issues, because it consists of high protein. Therefore, having such medical benefits, Greek yogurt is extending its revenue share of 3.4% CAGR in Europe. As yogurt is both eatable and drinkable it is highly demanded in the European market.

Eatable yogurt and drinkable yogurt are the most preferred probiotic food. This is the main factor that is driving the sales of probiotic foods such as yogurt, kombucha, and probiotic drinks across European consumers. Non-diary probiotic foods increased importance due to the prevalence of lactose-intolerant among a large number of European populations. This kind of increased penetration of dairy and non-dairy yogurts led the major companies rapidly invest in R&D activities for making innovative products such as sugar-free yogurt to gain a competitive advantage in the market across the region. Many major players offer frozen yogurt in the European market because there is high demand for lactose-free yogurt among lactose-intolerant consumers across the region. This is also the major factor that is driving the sales of yogurt companies in European market in the last few years.

The ongoing trend of dietary food for health-conscious people is making the demand for several types of yogurt in the European region. Therefore, Industries are expanding their overall market growth by implementing new marketing strategies to stay ahead in the yogurt market. Non-dairy yogurt has gained popularity due to the prevalence of lactose intolerance across the geriatric population in Europe. In producing quality yogurt, Germany and France are dominating the market in the region. Plant-based products such as eatable yogurt and drinkable yogurt are showing immense growth in both France and Germany. Therefore major players from these countries are launching more such products to gain profit from the European market. Besides this, Netherlands and Norway are also witnessing the highest CAGR growth in Europe yogurt market per year.

Key players in the Europe yogurt market are Chobani LLC, General Mills Inc., Danone SA, Nestlé S.A., Arla Foods amba, ESTI Foods Company, Ireland Group, Tesco Company, Raisio Group Food Company, Si Foods Ltd, Emmi Group, Fage International SA, Unilever Group (U.K), and Muller Company (Germany). These growing industries are rapidly becoming competitive with one another.

Scope of the Report:

|

Report Coverage |

Details |

||

|

Base Year: |

2021 |

Market Size in 2021: |

EUR 21.2 Billion |

|

Historical Data for: |

2019, 2020 and 2021 |

Forecast Period: |

2022 to 2032 |

|

Forecast Period 2022 to 2032 CAGR: |

2.9% |

2032 Value Projection: |

EUR 29.2 Billion |

|

Segments covered: |

By Products: Fresh yogurt, Drinkable yogurt (Fruit and Plain), Greek yogurt (Fruit and Plain), Coconut yogurt, Icelandic yogurt (Skyr) and others By Age Group: 0-18, 18-24, 24-40, 40-60 and 60+ |

||

|

Geographies covered: |

France, Germany, United Kingdom, Italy, Greek, Spain, Russia, and Rest of Europe Countries |

||

|

Companies covered: |

Chobani LLC, General Mills Inc., Danone SA, Nestlé S.A., Arla Foods amba, ESTI Foods Company, FAGE Internation S.A, Ireland Group, Tesco Company, Raisio Group Food Company, Si Foods Ltd, Emmi Group, Fage International SA, Unilever Group (U.K), and Muller Company (Germany). |

||

Europe Yogurt Market Has Been Segmented Into:

Europe Yogurt market - By Product Type:

- Fresh yogurt

- Drinkable yogurt (Fruit and Plain)

- Greek yogurt (Fruit and Plain)

- Coconut yogurt

- Icelandic yogurt (Skyr) and

- Others

Europe Yogurt Market – By Age Group:

- 0-18

- 18-24

- 24-40

- 40-60

- And 60+

Europe Yogurt Market - By Country:

- France

- Germany

- United Kingdom

- Italy

- Greek

- Spain

- Russia

- Rest of Europe Countries

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing