Morocco Automotive Market, (By Motor Types: PMSM, DC Brushless, AC Induction & Others. By Vehicle Type: Passenger Vehicles, Commercial Vehicles & Others. By Region - North America, Europe , Asia-Pacific , LAMEA) - Global Market Analysis, Growth, Trends & Forecast, 2022 to 2032

Report Type : Syndicate Report

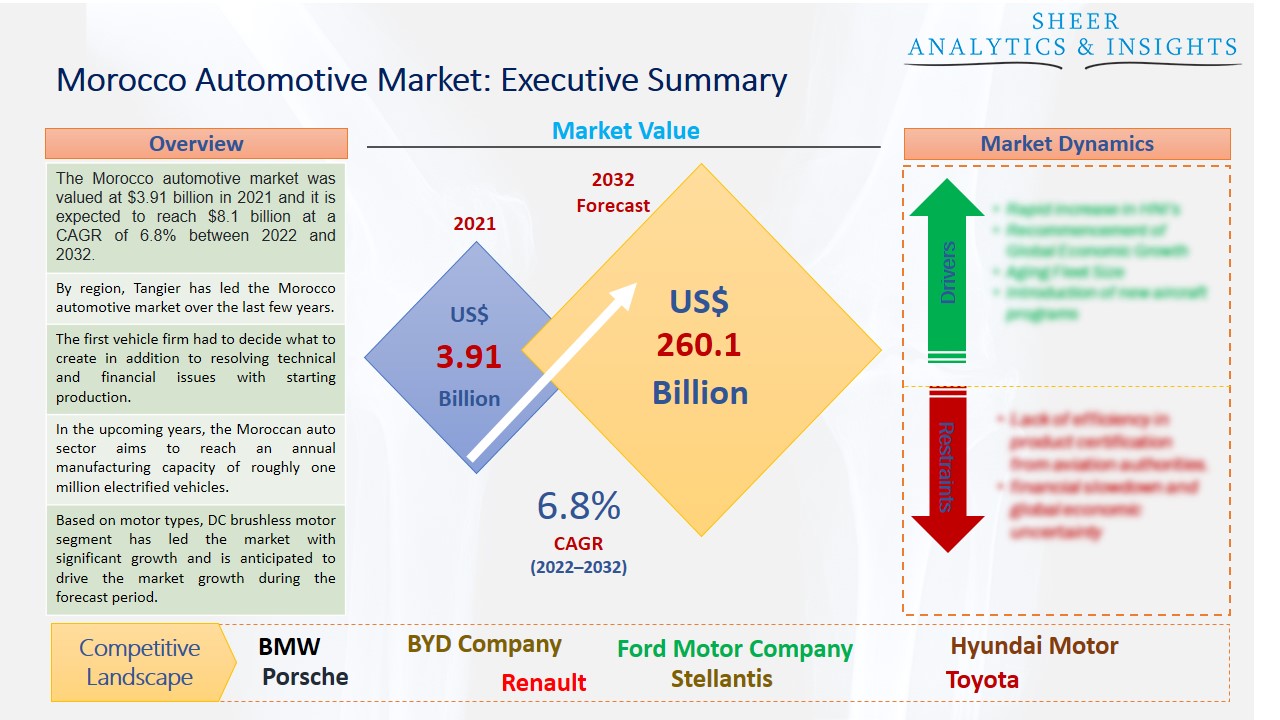

The Morocco automotive market was valued at $3.91 billion in 2021 and it is expected to reach $8.1 billion at a CAGR of 6.8% between 2022 and 2032. The government's mandated nationwide lockdown caused the supply chain to be interrupted, which prevented the market from expanding and forced several automakers to temporarily halt production. The vehicle type and drive type segments make up the Moroccan automotive market. The study provides market size and forecasts for all the aforementioned segments in terms of volume (in units) and value (in USD billions).

By region, Tangier has led the Morocco automotive market over the last few years.

The automotive industry refers to all businesses and endeavors concerned with the production of motor vehicles, including the majority of its parts, such as their bodywork and engines, but excluding their tires, batteries, and gasoline. Passenger cars and light trucks, including pickups, vans, and sport utility vehicles, are the main products of the sector. Despite being crucial to the business, commercial vehicles (such as delivery trucks and huge transport trucks, sometimes known as semis), are only second. The articles automobile, truck, bus, and motorbike cover the design of contemporary automobiles, while the articles gasoline engine and diesel engine describe automobile engines. In addition, in the section under "Transportation, History of," it is discussed how the vehicle developed. The majority of the earliest automobile manufacturers were small shops, hundreds of which each produced a handful of handcrafted automobiles, and nearly all of which quickly went out of business.

Source: SAI Research

Download Free PDF Sample Request

The first vehicle firm had to decide what to create in addition to resolving technical and financial issues with starting production. After the gasoline engine's first success, several people experimented with steam and electricity. Furthermore, the motor of an automobile is made to transform electrical energy into mechanical energy. The blending of electronics and mechanicals has increased the variety of vehicles available on the market and given autos convenience and comfort characteristics. For an automobile to operate effectively, much equipment, such as the power steering and seating controls, relies on electronic power. Moreover, the fourth-largest industry in the world is the automotive sector. India is currently the fourth-largest car manufacturer in the world and the seventh-largest producer of commercial vehicles. Two-wheelers and passenger cars account for the majority of the domestic Indian auto market. Hence, these primary factors are expected to accelerate market growth during the forecast period from 2022 to 2032.

In the upcoming years, the Moroccan auto sector aims to reach an annual manufacturing capacity of roughly one million electrified vehicles. To accomplish this, it will need to ensure the availability of batteries, which is crucial for this kind of vehicle. To do this, the Ministry of Industry and Trade declared in July of last year that it was in talks with battery producers about constructing a factory by the end of 2022. This plant will provide the automobile industry with a significant boost and speed up the transition to electric vehicles to cut carbon emissions. Morocco has committed to this project due to its cobalt reserves, which are necessary for the production of electric batteries. This commitment is in addition to the benefits that would result from the project.

Based on motor types, DC brushless motor segment has led the market with significant growth and is anticipated to drive the market growth during the forecast period across several regions of Morocco. The demand for this type of motor is increasing which is a plus point for the industrial market. Moreover, some of the frequently utilized automobile motors are traction, stepper, brushless direct current (DC), and DC motors. For improving performance, safety, comfort, convenience, and security, they are widely employed in passenger automobiles, battery electric vehicles (BEV), two-wheelers, heavy commercial vehicles (HCVs), plug-in hybrid electric vehicles (PHEV), and hybrid electric vehicles (HEV).

In terms of vehicle type, the commercial vehicle segment accounted for the largest share of the market and is also estimated to lead the market in the future. Heavy buses, small and heavy commercial vehicles and cars are the three main categories of automobiles. According to the type of fuel they can use—gasoline, diesel, electricity, and other fuels—automobiles are divided into different categories. The popularity of electric vehicles, or EVs, has increased recently. Additionally, there is a need for eco-friendly automobiles like CNG and flex-fuel vehicles in both the business and consumer automotive markets. However, according to overall manufacturing, passenger automobiles are also the most significant drivers driving the worldwide industry. The Market is also being driven by the growing population in developing nations. Consumer needs for luxuries and fuel-efficient features have changed regularly, modifying the technology. The rising demand for electric vehicles is fueling market expansion and shifting market patterns.

Geographically, Tangier province has led the market growth over the last few years and is also expected to hold its dominant position during the forecast period from 2022 to 2032 due to rising demand and adoption of automotive vehicles and accessories across this province. One such country is Morocco, which has invested in designated industrial areas like Tangier Automotive City and is currently experiencing a rise in the automotive industry. Without a doubt, shipping professionals are aware of Tangier, a Moroccan city that is home to one of the world's top 50 container ports. It was decided to build not only port facilities but also several industrial-free zones that worked closely together to expand the business and increase employment opportunities for locals. Currently, there are three such zones—the Tetouan Zone, the Tangier Automotive City (TAC), and the Tangier Free Zone—and there will be four soon.

According to the study, key players such as BMW (Germany), BYD Company (China), Fiat (Italy), Ford Motor Company (U.S), Hyundai Motor Company (South Korea), Porsche SE (Germany), Renault (France), Stellantis (Netherlands), Toyota (Japan), among others are leading the Morocco automotive market.

Scope of the Report:

| Report Coverage | Details |

| Market Size in 2021 | US$ 3.91 Billion |

| Market Volume Projection by 2032 | US$ 8.1 Billion |

| Forecast Period 2022 to 2032 CAGR | 6.8% |

| Base Year: | 2021 |

| Historical Data | 2019, 2020 and 2021 |

| Forecast Period | 2022 to 2032 |

| Segments covered |

By Motor Types: PMSM, DC Brushless, AC Induction & Others By Vehicle Type: Passenger Vehicles, Commercial Vehicles & Others |

| Geographies covered |

Morocco |

| Companies covered | BMW (Germany), BYD Company (China), Fiat (Italy), Ford Motor Company (U.S), Hyundai Motor Company (South Korea), Porsche SE (Germany), Renault (France), Stellantis (Netherlands), Toyota (Japan), among others. |

The Morocco Automotive Market Has Been Segmented Into:

The Morocco Automotive Market – by Motor Types:

- PMSM

- DC Brushless

- AC Induction

- Others

The Morocco Automotive Market – by Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- Others

The Morocco Automotive Market – by Regions:

- Tangier

- Oujda

- Fes

- Rabat

- Others

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing