Africa Skincare Market (By Ingredient Type: Natural, Chemical, Others. By Distribution: Offline, Online. By Gender: Male, Female & Others. By Region) - Industry Analysis, Growth, Trends & Forecast, 2022 to 2032

Report Type : Syndicate Report

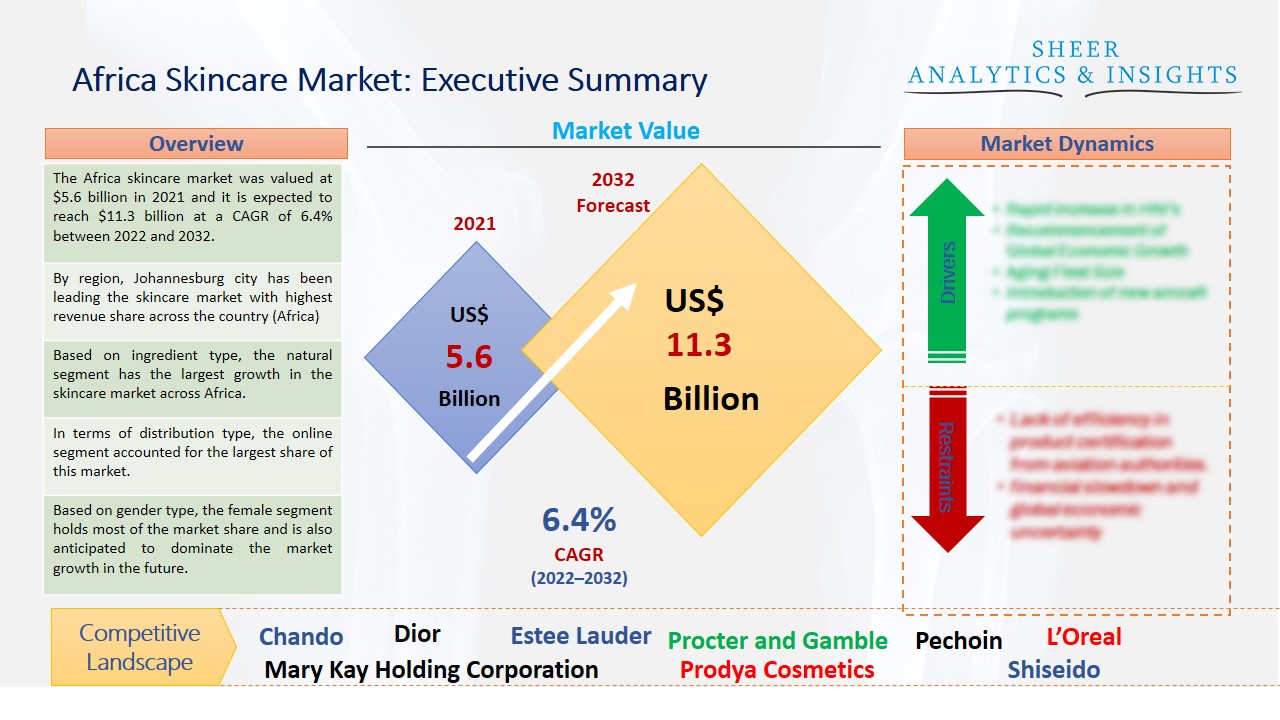

The Africa skincare market was valued at $5.6 billion in 2021 and it is expected to reach $11.3 billion at a CAGR of 6.4% between 2022 and 2032. The art of skincare involves treating skin diseases and improving skin attractiveness. It involves feeding the skin nutrients and utilizing emollients to delay aging. Cosmetics, botulinum, exfoliation, fillers, laser resurfacing, microdermabrasion, retinol therapy, and ultrasonic skin treatment are all included in the skin care regimen.

By region, Johannesburg city has been leading the skincare market with highest revenue share across the country (Africa)

Dermatitis and skin damage can be avoided by practicing everyday skin care. Frequently, consumers favor skin care products made with organic and natural ingredients. Clinical and laboratory research has found that natural products outperform synthetic ones in terms of advantages. A significant portion of South Africa's workforce is made up of women, which is another important aspect that is driving up demand for skin care products in the nation. The market is expanding as more women in the nation are gravitating toward herbal and natural substances made from vegetable extracts, such as lavender and aloe vera.

Source: SAI Research

Download Free PDF Sample Request

Even by its brands, the African cosmetics industry is largely underserved. The fact that skin types in Western and European markets are frequently comparable is one of the factors contributing to how simple it is to advertise these products. As a result, several brands may have adjusted to the skin requirements of these markets under the weather in these countries. If African firms want their market to grow more quickly, they must embrace everything about it, from their branding to their products.

Long-term demand for anti-aging products like anti-wrinkle creams, face creams, serums, eye creams, and others is rising as a result of additional factors such as pollution and hard water conditions. People are becoming more and more aware of how pollution affects their skin. Furthermore, there is a demand for affordable, high-quality skincare products that cater to the needs of numerous ethnic groups while also satisfying the demand for natural ingredients, given the rise of the middle class in South Africa and increased purchasing power across several socio-economic categories.

The desire for both domestic and foreign items divides the beauty market. African buyers often demand reliable, high-quality products that are within their price range. Furthermore, depending on regional lifestyles, customs, and spending power, consumers frequently switch between local and international brands. In Sub-Saharan Africa, items for body care are more common than face cosmetics and makeup, despite the market's high potential.

Based on ingredient type, the natural segment has the largest growth in the skincare market across Africa. Women in South Africa, in particular, strongly favor natural active substances derived from vegetable extracts, such as lavender, aloe vera, and other essential oils. Many manufacturers are releasing novel products with active components as they keep an eye on the trend. To meet the rising demand for products made from naturally sourced materials, businesses are acquiring, merging, and releasing innovative products.

In terms of distribution type, the online segment accounted for the largest share of this market. Over the past few years, the online segment has grown due to rising demand among a large number of consumers men and women. However, the offline market is also growing with a significant share. Supermarkets and hypermarkets are rising in demand. Most African consumers like to purchase their favorite skincare cosmetics through offline retail stores. Hence, these would accelerate the market growth for skincare products.

Based on gender type, the female segment holds most of the market share and is also anticipated to dominate the market growth in the future. African women now make up a larger portion of the middle class and have greater purchasing power. Many African women from the middle class are now able to pursue lucrative professional professions because of higher education. In addition to the cash that women generate for themselves, males also play a role in the significant expenditure on cosmetics.

Geographically, Johannesburg has been dominating the market with the largest market share. Moreover, other cities such as Tshwane, Cape Town, and Durban, among others also held a major market share of skincare companies. Due to numerous awareness efforts and promotions done by associations and notable players, consumers in these cities are progressively becoming more focused while buying beauty and personal care items.

According to the study, key players such as Amka Products (South Africa), Avon Products (U.S), Aaron Cosmetics (India), Bayer AG (Germany), Clarins (France), Esse Skincare (South Africa), FTG Holdings (Kenya), Juvia’s Place LLC (U.S), Johnson and Johnson (U.S), L’Oreal (France), Lulu and Marula (South Africa), Lee Chem Laboratories (South Africa), MacAndrews and Forbes (U.S), Procter and Gamble (U.S), Pauline Cosmetics (Kenya), Unilever Plc (U.K), Shisido (Japan), Tiger Brands (South Africa), The Estee Lauder (U.S), among others are leading the Africa skincare market.

Scope of the Report:

| Report Coverage | Details |

| Market Size in 2021 | US$ 5.6 Billion |

| Market Volume Projection by 2032 | US$ 11.3 Billion |

| Forecast Period 2022 to 2032 CAGR | 6.4% |

| Base Year: | 2021 |

| Historical Data | 2019, 2020 and 2021 |

| Forecast Period | 2022 to 2032 |

| Segments covered |

By Ingredient Type: Natural, Chemical, Others By Distribution Type: Offline, Online By Gender Type:, Male, Female & Others |

| Geographies covered |

Africa: (Johannesburg, Tshwane, Cape Town, Durban, Buffalo City & Rest of the African cities) |

| Companies covered | Amka Products (South Africa), Avon Products (U.S), Aaron Cosmetics (India), Bayer AG (Germany), Clarins (France), Esse Skincare (South Africa), FTG Holdings (Kenya), Juvia’s Place LLC (U.S), Johnson and Johnson (U.S), L’Oreal (France), Lulu and Marula (South Africa), Lee Chem Laboratories (South Africa), MacAndrews and Forbes (U.S), Procter and Gamble (U.S), Pauline Cosmetics (Kenya), Unilever Plc (U.K), Shisido (Japan), Tiger Brands (South Africa), The Estee Lauder (U.S), among others |

The Africa Skincare Market Has Been Segmented Into:

The Africa Skincare Market – by Ingredient Type:

- Natural

- Chemical

- Others

The Africa Skincare Market – by Distribution Type:

- Offline

- Online

The Africa Skincare Market – by Gender Type:

- Male

- Female

- Others

The Africa Skincare Market – by Regions:

Africa

- Johannesburg

- Tshwane

- Cape Town

- Durban

- Buffalo City

- Rest of the African cities.

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing