Algorithmic Trading Market (By Trading: Foreign Exchange, Stock Materials, Crypto currency, Bonds & Others. By Component: Solutions, Services & Others. By Deployment Type: Cloud-Based, On-Premises & Others. By Region - Global Market Analysis, Growth, Trends & Forecast, 2033

Report Type : Syndicate Report

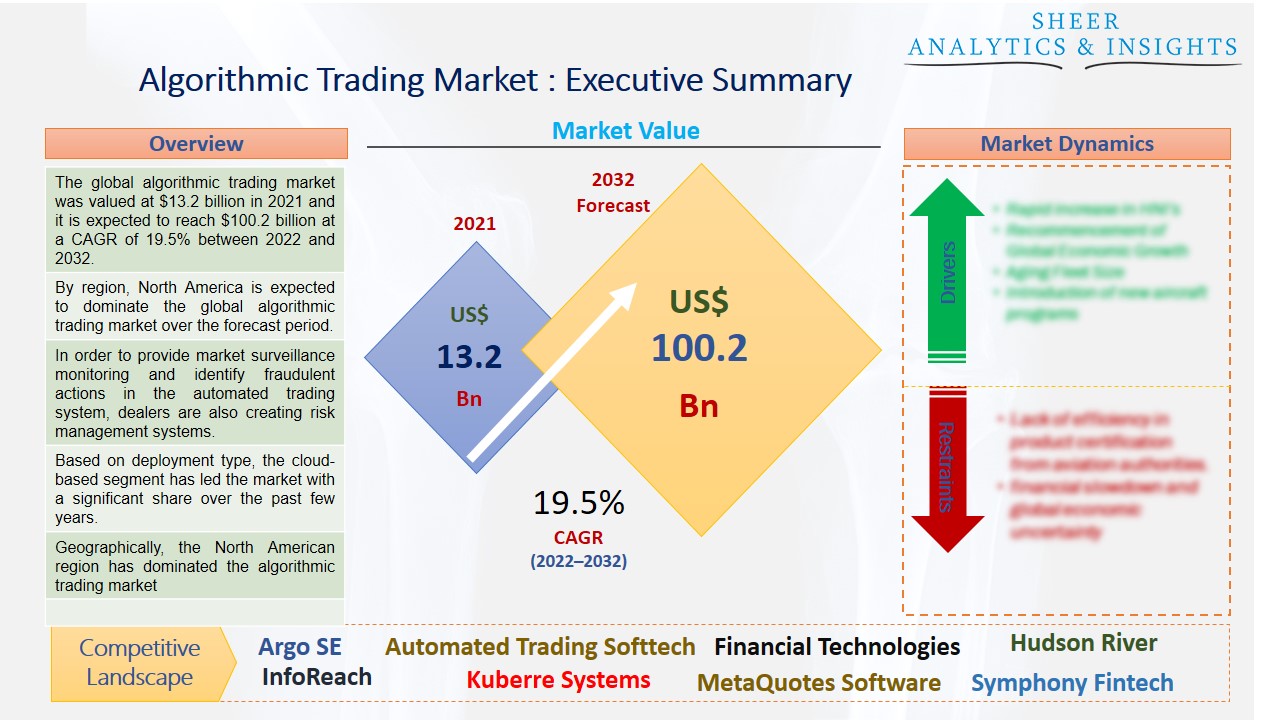

The global algorithmic trading market was $15.6 billion in 2022 and it is expected to reach $119.9 billion at a CAGR of 19.2% between 2023 and 2033. The market for algorithmic trading is anticipated to expand as a result of the rise in demand for trustworthy, efficient, and quick order execution. Large brokerage firms and institutional investors are increasingly utilizing algorithmic trading to save trading expenses. This can be explained by the fact that algorithmic trading facilitates faster and easier order execution, which draws exchanges.

By region, North America is expected to dominate the global algorithmic trading market over the forecast period.

Using computer programs and software to open and execute trades under predetermined rules, such as price movement points in an underlying market, is known as algorithmic trading. Trading algorithms (algos) can execute a buy or sell order on your behalf once the current market conditions meet any predetermined criteria, saving you time by removing the need to manually search the markets. Through our alliances with cutting-edge platforms like ProRealTime and MetaTrader 4 (MT4), as well as through our own native APIs, you may trade with algorithms with us. To make algorithmic trading simple for you, whether you wish to create and fully configure your algorithms or utilize pre-made solutions, we also provide cutting-edge technical analysis and charting tools. Moreover, the market for algorithmic trading is growing as financial markets and market surveillance become more integrated. The expansion of financial institutions and the increase in investments are having a beneficial effect on the market expansion. In algorithmic trading, a computer program is run according to a predetermined set of instructions, some of which include purchasing or selling an item. The market is expanding more quickly thanks to lower transaction costs, automatic inspections of various market circumstances, and trade execution at the best pricing. High-frequency trading technology is used by algorithmic traders, allowing the company to execute tens of thousands of trades per second.

Source: SAI Research

Download Free PDF Sample Request

Furthermore, the adoption of algorithmic trading and growing awareness of financial technology advancements like algorithms and the use of business intelligence analytics tools have increased the demand for algorithmic trading and created new opportunities for major players in the global algorithmic trading market. Additionally, the use of AI and cloud-based solutions are having a beneficial impact on the market. Algorithmic trading makes it feasible to generate profits quickly and trade more frequently than any human trader could ever hope to. The main element fueling the market's expansion is the advantage of algorithmic trading. Businesses are placing a strong emphasis on procedures for constructing low-risk infrastructure and improving data management plans through algorithmic trading. In addition, the development of artificial intelligence (AI) is a significant driver of market growth. Through risk sharing, worldwide dispersion of savings, and portfolio diversification, AI helps to create profitable trading possibilities. In addition, the market is expanding due to the growing popularity of cloud computing in both developed and developing countries.

In order to provide market surveillance monitoring and identify fraudulent actions in the automated trading system, dealers are also creating risk management systems.

Based on trading types, foreign exchange and exchange-traded fund segments hold most of the market and are estimated to propel the market growth during the forecast period. Due to the increased need for automated trading around the world, the ETF segment is the one in the algorithmic trading market that is developing at the highest rate. ETFs offer traders low average expenses so they can earn from the ETFs as much as possible. In essence, an algorithm is a set of precise instructions created to carry out a predetermined task. In financial market trading, computers execute user-defined algorithms that are characterized by a set of guidelines that determine deals, such as time, price, or quantity.

In terms of component type, the solution category accounted for the largest share of the market and is also expected to drive market growth over the forecast period. The demand for algorithmic trading solutions is primarily driven by their benefits, which include lower transaction costs due to the lack of human intervention and speedy and accurate trade order placement. To accommodate a variety of consumer needs, market participants are also offering advanced algorithmic trading tools. However, the services category is expected to grow significantly throughout the projected period due to the widespread acceptance of professional services among end users, which ensures the successful and seamless functioning of algorithmic trading systems.

Based on deployment type, the cloud-based segment has led the market with a significant share over the past few years. To maximize profits and efficiently automate the trading process, the majority of suppliers in the algorithmic trading market provide cloud-based trading solutions. Cloud-based algorithmic trading solutions are anticipated to become more popular as a result of features including simple trade data maintenance, cost-effectiveness, scalability, and efficient management. Additionally, traders are increasingly using cloud-based algorithmic trading solutions because they ensure effective process automation, data preservation, and cost-effective management.

Geographically, the North American region has dominated the algorithmic trading market across the globe and is anticipated to hold its dominant position in the future. Throughout the projection period, higher investments in trading technologies like blockchain, the expansion of algorithmic trading suppliers, and rising government support for international trade will be the main drivers of market growth in this area. Significant technological improvements and the extensive use of algorithm trading in a variety of applications, including banks and financial institutions throughout the area, are also expected to fuel market expansion. On the other hand, the Asia-Pacific region is also estimated to become the second-fastest growing market during the forecast period. Furthermore, the reason for this market's fastest growth rate is the significant investments that both the public and private sectors have made to improve their trading technology. As a result, there is now more demand for algorithmic trading solutions, which are utilized to automate the trading process.

According to the study, key players such as Argo SE (U.S), Automated Trading Softtech (India), Financial Technologies Group (India), Hudson River Trading (U.S), iRage Capital (India), InfoReach (U.S), Kuberre Systems (U.S), MetaQuotes Software (Russia), Symphony Fintech (India), Software AG (Germany), Tata Group (India), The WoodBridge Company (Canada), UTrade Solutions (India), Virtu Financial (U.S), among others are leading the global algorithmic trading market.

Scope of the Report:

| Report Coverage | Details |

| Market Size in 2022 | US$ 15.6 Billion |

| Market Volume Projection by 2033 | US$ 119.9 Billion |

| Forecast Period 2023 to 2033 CAGR | 19.2% |

| Base Year: | 2023 |

| Historical Data | 2020 and 2022 |

| Forecast Period | 2022 to 2033 |

| Segments covered |

By Trading Types: Foreign Exchange, Stock Materials, Crypto currency, Bonds & Others By Component Type: Solutions, Services & Others By Deployment Type: Cloud-Based, On-Premises & Others |

| Geographies covered |

North America, Europe, Asia-Pacific, Australia |

| Companies covered | Argo SE (U.S), Automated Trading Softtech (India), Financial Technologies Group (India), Hudson River Trading (U.S), iRage Capital (India), InfoReach (U.S), Kuberre Systems (U.S), MetaQuotes Software (Russia), Symphony Fintech (India), Software AG (Germany), Tata Group (India), The WoodBridge Company (Canada), UTrade Solutions (India), Virtu Financial (U.S) , among others |

The Global Algorithmic Trading Market Has Been Segmented Into:

The Global Algorithmic Trading Market – by Trading Types:

- Foreign Exchange

- Stock Materials

- Crypto currency

- Bonds

- Others

The Global Algorithmic Trading Market – by Component Type:

- Solutions

- Services

- Others

The Global Algorithmic Trading Market – by Deployment Type:

- Cloud-Based

- On-Premises

- Others

The Global Algorithmic Trading Market – by Regions:

- North America

- Citadel Securities

- Two Sigma Investments

- Virtu Financial

- Jump Trading

- IMC Financial Markets

- Tower Research Capital

- DRW Trading

- Hudson River Trading

- Flow Traders

- GSA Capital Partners

- Europe

- Optiver

- Akuna Capital

- SIG Trading

- Citadel Europe

- Millennium Global

- FlowBank

- ICAP

- IMC Pan-European

- GTX

- Cboe Europe

- Asia

- OneZero

- Tiger Brokers

- XR Trading

- Jump Trading Asia

- Virtu Financial Asia

- IMC Asia

- Flow Traders Asia

- CLSA

- Goldman Sachs (Asia)

- Morgan Stanley (Asia)

- Australia

- IG Group

- CMC Markets

- Pepperstone

- Vantage FX

- City Index

- Gain Capital

- AxiTrader

- FxPro

- IC Markets

- XTB

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing