Asia and Europe Payment Gateway Market, (By Type: Hosted, Non-Hosted, By Enterprise Type: Small and Medium Enterprise, Large Enterprise. By End-User: BFSI, Media and Entertainment, Retail and E-Commerce, Travel and Hospitality & Others. By Region - Asia and Europe) | Industry Size, Share, Analysis, and Forecast 2022-2032

Report Type : Syndicate Report

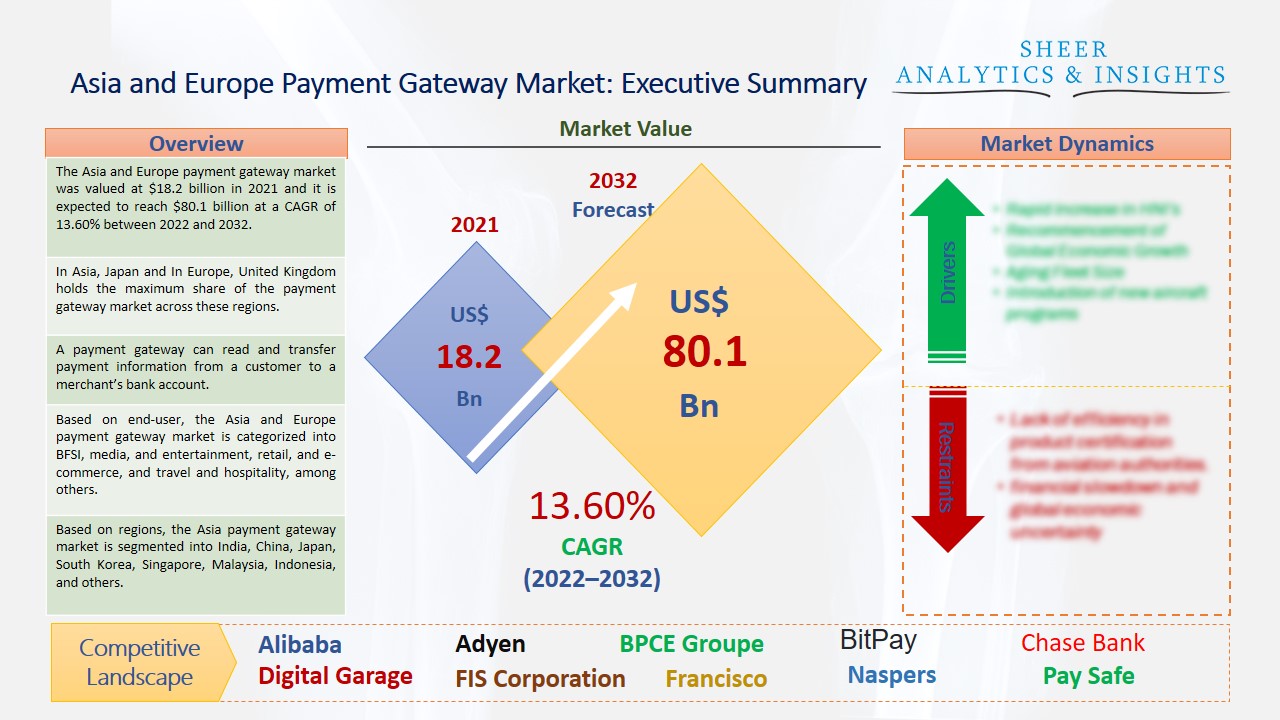

The Asia and Europe payment gateway market was valued at $18.2 billion in 2021 and it is expected to reach $80.1 billion at a CAGR of 13.60% between 2022 and 2032. The payment gateway works as the medium between customers and the merchants and assuring the transaction that is carried out safely and promptly. Online payment gateway can make the transaction easier for merchants to integrate the necessary software. If anyone wants to accept credit card payments, they would need a payment gateway.

In Asia, Japan and In Europe, United Kingdom holds the maximum share of the payment gateway market across these regions.

A payment gateway can read and transfer payment information from a customer to a merchant’s bank account. Thus, the main task of this system is to capture the data, assure funds that are available and get a merchant paid. Furthermore, an online payment gateway is cloud-based software that can help a customer to connect with a merchant. This way, a cardholder uses the card to make a payment. Due to the increasing usage of mobile phones and payment applications, rising e-commerce sales and growing internet connection are some significant factors that are projected to drive the growth of the market throughout the forecast period. In addition, a large number of customers and merchants across the Asia and Europe region are shifting themselves to online payment services, which is also estimated to propel the market growth in upcoming years. Due to the rise in smart mobile users, the Asia region is outpacing other regions in terms of online transaction adoption. People are rapidly using internet connections, which are expected to witness significant growth during the upcoming years in Asia. In China, digital payment applications such as Alibaba and Tencent are the two major payment methods that play an essential role in the Chinese economy’s transition away from cash.

Source: SAI Research

Based on type, the Asia and Europe payment gateway market is segmented into hosted and non-hosted. The hosted segment accounts for the largest share in the market in both Asia and Europe region. Due to the rising demand for hosted segments, payment gateway is growing among a large number of consumers and merchants. With factors such as easy payment setting and system and decreased liabilities among customers and merchants, the hosted segment is expected to support the payment gateway market across Asia and Europe continent. Based on enterprise type, the Asia and Europe payment gateway market is categorized into small, medium, and large enterprises. Among these, the large enterprise category is projected to boost the market growth during the upcoming years. In addition, large enterprises are getting a higher number of visits from a increasing number of consumers on their websites; therefore, those enterprises have to deploy cost-effective solutions for their consumers during the checkout process. Small and medium categories are also expected to witness significant growth which would support the market in both Asia and Europe regions. Due to new business strategies for restructuring their business and increasing adoption of digital approaches, this segment is also estimated to propel the payment gateway market across Asia and Europe continent.

Based on end-user, the Asia and Europe payment gateway market is categorized into BFSI, media, and entertainment, retail, and e-commerce, and travel and hospitality, among others. The retail and e-commerce segment is accounted to have a significant market share. The rising number of online payments and transactions, growing usage of online e-commerce services, and increasing demand for online retailing across both the Asia and Europe regions are anticipated to drive the growth of the market in the forecast period from 2022 to 2032. Besides this, the BFSI category is also anticipated to witness notable growth over the forecast period. In Asia and Europe regions, the BFSI sectors are widely adopting payment gateway services and providing an end-to-end and secure ecosystem for financial services.

Based on regions, the Asia payment gateway market is segmented into India, China, Japan, South Korea, Singapore, Malaysia, Indonesia, and others. China is dominating the payment gateway market across this region due to the increasing adoption of mobile phones and digital transaction applications. Other developing countries are also expected to witness significant growth due to rising usage of internet connections and growing sales of mobile phones.

Based on regions, the Europe payment gateway market is segmented into the United Kingdom, France, Germany, Italy, Netherlands, Poland, and others. Among these, the United Kingdom is dominating the payment gateway market and the country holds the maximum market share. Hence, the country is expected to drive the market growth due to increasing usage of mobile phones, and payment methods applications.

Recently, China-based Company Alibaba Group has launched a Cross-Border payment service named Alibaba.Com Pay, which primarily serves small, medium-sized business customers engaged in cross-border foreign trade. This initiative is aimed to become the world’s leading business-oriented cross-border financial service. Givex launched GivexPay, powered by Adyen, the global payment platform of choice for many of the world’s leading companies which provides merchants with useful customer insights. Worldline announced to offer its first payment international service provider to unlock the full potential of WeChat Pay by offering payments through official accounts and mini-programs which represent almost all of WeChat’s flow. Therefore, these new payment gateway launches are projected to drive market growth during the forecast period.

According to the study, key players such as 99Bill (China), Alibaba Group (China), Apple (U.S), Alphabet Inc (U.S), Adyen (Netherlands), Amazon.Com (U.S), BPCE Groupe (France), BitPay (U.S), CCAvenue (India), China PnR (China), Chase Bank (U.S), Digital Garage Inc (Japan), FIS Corporation (U.S), Francisco Partners (U.S), Naspers (South Africa), One97 Communications (India), Pay Safe (U.K), PayEase (U.S), PayPal (U.S), RazorPay (India), Stripe (U.S), UnionPay (China), Visa Financial Services (U.S), WorldLine (France), WechatPay (China), among others are leading the Asia and Europe payment gateway market.

Scope of the Report:

|

Report Coverage |

Details |

| Market Size in 2021 | US$ 18.2 billion |

| Market Volume Projection by 2032 | US$ 80.1 billion |

| Forecast Period 2022 to 2032 CAGR | 13.60% |

| Base Year: | 2021 |

| Historical Data | 2019, 2020 and 2021 |

| Forecast Period | 2022 to 2032 |

| Segments covered |

By Type: Hosted, Non-Hosted By Enterprise Type: Small and Medium Enterprise, Large Enterprise By End-User: BFSI, Media and Entertainment, Retail and E-Commerce, Travel and Hospitality & Others |

| Geographies covered |

Asia: India, China, Japan, Indonesia, South Korea, Singapore, Rest of the Asian Countries Europe: United Kingdom, France, Germany, Italy, Netherlands, Poland, Rest of the European Countries |

| Companies covered | 99Bill (China), Alibaba Group (China), Apple (U.S), Alphabet Inc (U.S), Adyen (Netherlands), Amazon.Com (U.S), BPCE Groupe (France), BitPay (U.S), CCAvenue (India), China PnR (China), Chase Bank (U.S), Digital Garage Inc (Japan), FIS Corporation (U.S), Francisco Partners (U.S), Naspers (South Africa), One97 Communications (India), Pay Safe (U.K), PayEase (U.S), PayPal (U.S), RazorPay (India), Stripe (U.S), UnionPay (China), Visa Financial Services (U.S), WorldLine (France), WechatPay (China), among others |

Asia and Europe Payment Gateway Market Has Been Segmented Into:

Asia and Europe Payment Gateway Market – by Type:

- Hosted

- Non-Hosted

Asia and Europe Payment Gateway Market – by Enterprise Type:

- Small and Medium Enterprise

- Large Enterprise

Asia and Europe Payment Gateway Market – by End-User:

- BFSI

- Media and Entertainment

- Retail and E-Commerce

- Travel and Hospitality

- Others

Asia and Europe Payment Gateway Market – by Regions:

Asia

- India

- China

- Japan

- Indonesia

- South Korea

- Singapore

- Rest of the Asian Countries

Europe

- United Kingdom

- France

- Germany

- Italy

- Netherlands

- Poland

- Rest of the European Countries

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing