Asia-Pacific Sugar Substitute Market (By Products: High-Intensity Sweeteners, Low-Intensity Sweeteners & High Fructose Syrup. By Application: Food, Beverages, Health & Personal Care & Others By Region - Asia-Pacific) - Industry Analysis, Growth, Trends & Forecast, 2022 to 2032

Report Type : Syndicate Report

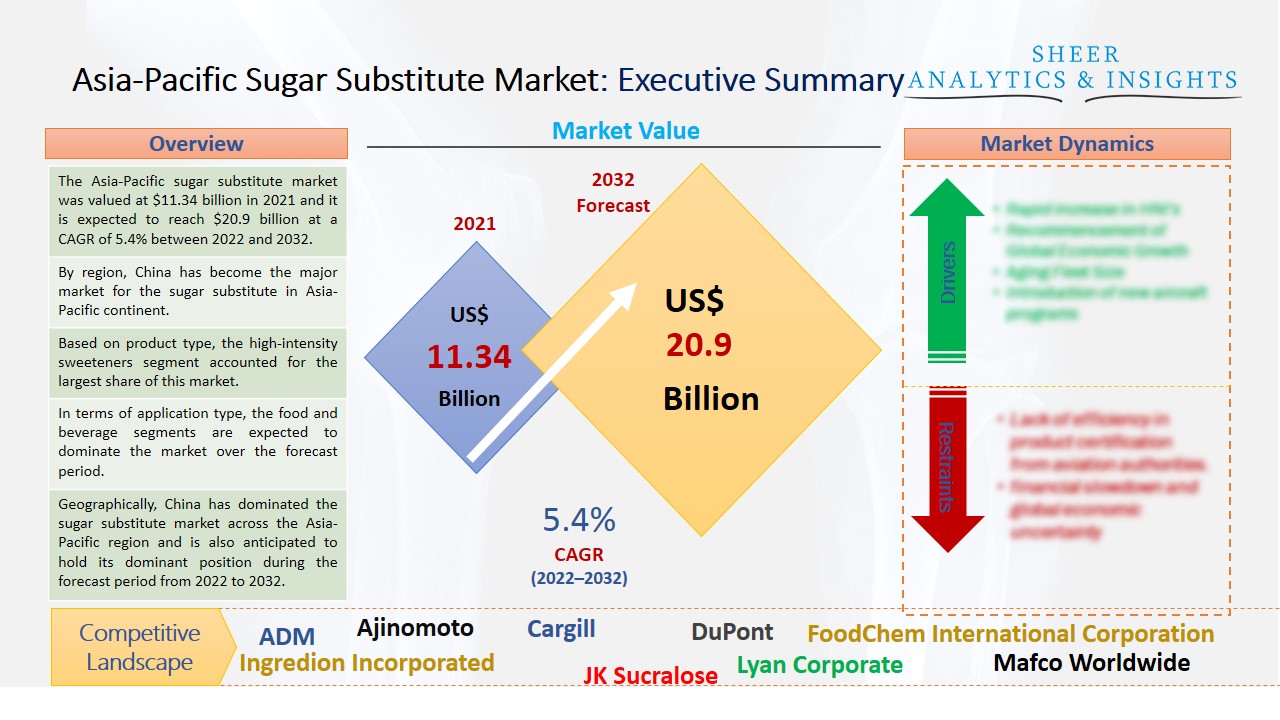

The Asia-Pacific sugar substitute market was valued at $11.34 billion in 2021 and it is expected to reach $20.9 billion at a CAGR of 5.4% between 2022 and 2032. A wide variety of sugar replacements are replacing regular sugar, which has many calories, in the food and beverage business. The products that use sugar substitutes include diet beverages, cereals, nutritional snacks, and sweets without added sugar. This rising demand is estimated to make huge growth for the market.

By region, China has become the major market for the sugar substitute in Asia-Pacific continent.

High fructose corn syrup is frequently chosen as a sugar substitute in foods like flavored juices, soft drinks, and other carbonated beverages. Syrup is becoming more and more well-liked in China, where it has a market share of about 50% compared to other sweeteners. High fructose corn syrup is becoming more and more affordable, with prices around a third lower than those of other natural sweeteners. High fructose syrup production and consumption are increasing, which has contributed to the expansion of the Asia-Pacific market for sugar replacements.

Source: SAI Research

Download Free PDF Sample Request

To match the shifting consumer demand, many food and beverage producers use no-calorie sweeteners, which are predicted to fuel market expansion throughout the projection period. Low-Calorie Sweeteners are sugar replacements that sweeten food more effectively per gram than sugar does. In addition to gums, frozen desserts, gelatins, sweets, baked goods, morning cereals, pudding, and yogurt, LCS is present in a wide variety of foods and drinks. Hence, this rising demand is gradually increasing which would help the market to gain more growth opportunities across the Asia-Pacific region.

Due to higher middle-class living standards and more consumer buying power, the Asia Pacific area offers enormous market potential for the production of sugar substitutes. Additionally, today’s fast-rising consumer desire for healthier foods will help the industry's expansion. Compared to regular sugar, artificial sugar is over 200 times sweeter. Furthermore, high fructose corn syrup is frequently chosen as a sugar substitute in foods like flavored juices, soft drinks, and other carbonated beverages. Syrup is becoming more and more well-liked in China, where it has a market share of about 50% compared to other sweeteners. High fructose corn syrup is becoming more and more affordable, with prices around a third lower than those of other natural sweeteners.

Due to research showing that sugar alcohols like sorbitol and maltitol can cause digestive issues, natural sweeteners like stevia are quickly replacing them on the market. Stevia has been used as a natural clean-label sweetener by both food and beverage makers to boost innovation and product launches. Clean Label has sparked a desire for natural sweeteners, especially stevia. A lot of important players are concentrating on developing new business growth techniques. Additionally, this would later benefit the market.

Based on product type, the high-intensity sweeteners segment accounted for the largest share of this market and is also expected to help the market to gain more growth. The Asian market has dominated the high-fructose syrup industry for the past several years due to the rising demand for HFCS in soft drinks, which has increased China's consumption of the product by more than 7% from prior years. Less high-intensity sweeteners are needed to obtain the same sweetness as table sugar because they are significantly sweeter than sugar. In the upcoming years, high-intensity sweetness will likely become more prevalent due to the expanding health and well-being trend around the world.

In terms of application type, the food and beverage segments are expected to dominate the market over the forecast period. This is a result of consumers' rising demand for formulations with little or no calories. The market for sugar alternatives is also predicted to expand, notably for natural sweeteners made from monk fruit, agave, and stevia, among other sources. To satisfy the increased consumer demand for healthier products, businesses prefer natural sweeteners over artificial ones. In the next years, the market would be driven by these desires.

Geographically, China has dominated the sugar substitute market across the Asia-Pacific region and is also anticipated to hold its dominant position during the forecast period from 2022 to 2032. The country's large manufacturing and elderly population will further fuel the demand for sugar substitute products there. In addition, China is emerging as a significant end-user market for sugar alternatives due to its large and rapidly expanding end-user industries. The rapid development of the end-user sectors, particularly those of functional foods and beverages, glazed fruits, tea and juice beverages, medications, and other items, was what propelled this spectacular growth.

According to the study, key players such as ADM (U.S), Ajinomoto (Japan), Cargill (U.S), DuPont (U.S), Discovery (U.S), FoodChem International Corporation (China), HSWT (Germany), Ingredion Incorporated (U.S), JK Sucralose (India), Lyan Corporate (U.S), Mafco Worldwide (U.S), Mitsui DM Sugar Holdings (Japan), NutraSweet (U.S), PureCircle (U.S), Roquette Freres (France), Tate and Lyle Plc (U.K), ZuChem Inc (U.S), among others are leading the Asia-Pacific sugar substitute market.

Scope of the Report:

| Report Coverage | Details |

| Market Size in 2021 | US$ 11.34 Billion |

| Market Volume Projection by 2032 | US$ 20.9 Billion |

| Forecast Period 2022 to 2032 CAGR | 5.4% |

| Base Year: | 2021 |

| Historical Data | 2019, 2020 and 2021 |

| Forecast Period | 2022 to 2032 |

| Segments covered |

By Products Type: High-Intensity Sweeteners, Low-Intensity Sweeteners & High Fructose Syrup By Application Type: Food, Beverages, Health and Personal Care & Others |

| Geographies covered |

Asia-Pacific |

| Companies covered | ADM (U.S), Ajinomoto (Japan), Cargill (U.S), DuPont (U.S), Discovery (U.S), FoodChem International Corporation (China), HSWT (Germany), Ingredion Incorporated (U.S), JK Sucralose (India), Lyan Corporate (U.S), Mafco Worldwide (U.S), Mitsui DM Sugar Holdings (Japan), NutraSweet (U.S), PureCircle (U.S), Roquette Freres (France), Tate and Lyle Plc (U.K), ZuChem Inc (U.S), among others. |

The Asia-Pacific Sugar Substitute Market Has Been Segmented Into:

The Asia-Pacific Sugar Substitute Market – by Products Type:

- High-Intensity Sweeteners

- Low-Intensity Sweeteners

- High Fructose Syrup

The Asia-Pacific Sugar Substitute Market – by Application Type:

- Food

- Beverages

- Health and Personal Care

- Others

The Asia-Pacific Sugar Substitute Market – by Regions:

- Asia Pacific

- India

- China

- Japan

- Australia

- Rest of Asia-Pacific

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing