Automotive Brake System Market (By Brake Type: Disc & Drum. By Vehicle Type: Commercial Cars & Passenger Car . By Technology Type: Antilock Braking System, Electrical Stability Control, Traction Stability Control & Electronic Brake-force Distribution. By Region - North America, Europe , Asia-Pacific , LAMEA) - Global Market Analysis, Growth, Trends & Forecast, 2022-2032

Report Type : Syndicate Report

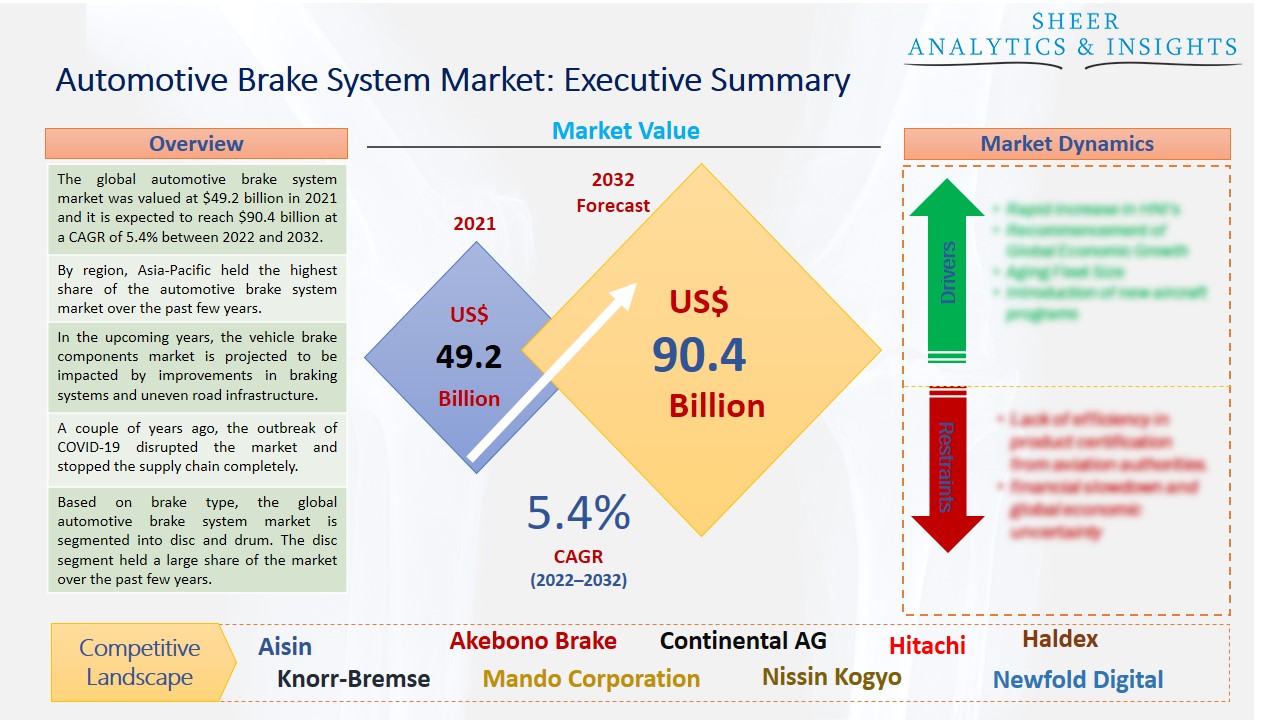

The global automotive brake system market was valued at $49.2 billion in 2021 and it is expected to reach $90.4 billion at a CAGR of 5.4% between 2022 and 2032. Strict safety regulations, the adoption of high-end vehicles, and an increase in the use of disc brakes in commercial vehicles are all contributing to the market's expansion. Additionally, only a certain number of kilometers can be covered by brake components before they need to be replaced, which is driving up the replacement market.

By region, Asia-Pacific held the highest share of the automotive brake system market over the past few years.

The function of a brake system is to slow down and stop a moving object. To achieve this, several brake system components must transform the kinetic energy of the vehicle into heat. Friction is used for this. The resistance to motion that two things impose on one another is known as friction. The function of a brake system is to slow down and stop a moving object. To achieve this, several brake system components must transform the kinetic energy of the vehicle into heat. Friction is used for this. The resistance to motion that two things impose on one another is known as friction. Through friction, the brake system transforms the kinetic energy of your moving vehicle into thermal energy. Moreover, several benefits of the automotive brake system are expected to accelerate market growth during the forecast period. For instance, the most crucial automobile safety feature is your brakes. Brakes allow you to instantly slow down or stop, which can prevent major accidents. When you need your brakes the most, poorly maintained and infrequently tested brakes may fail you. In addition, particularly in slick or rainy conditions, they give the driver extra stability and keep the car from spinning out of control. Anti-lock braking systems (ABS) are among the most crucial safety elements in contemporary vehicles. These benefits and rising factors are anticipated to drive the market during the forecast period.

Source: SAI Research

Download Free PDF Sample Request

In the upcoming years, the vehicle brake components market is projected to be impacted by improvements in braking systems and uneven road infrastructure. The requirement for increased active and passive vehicle safety is driving up demand for effective automotive brake components such as brake calipers, brake liners, and brake shoes. Additionally, the development of R&D aimed at the introduction of new technologies as well as the involvement of market participants in the introduction of new and enhanced systems are the factors fueling the market expansion throughout the forecast period. On the other hand, the growing popularity of electric vehicles and the increased attention being paid to autonomous vehicles are anticipated to increase the manufacturing businesses' potential for commercial growth soon. Hence, these primary factors would create growth opportunities for the global automotive brake system market during the forecast period.

A couple of years ago, the outbreak of COVID-19 disrupted the market and stopped the supply chain completely. The subsequent closure of the assembly plants disrupted production and stopped the export of Chinese components. Additionally, the global travel restrictions imposed by the governments of Europe, Asia, and North America have hampered opportunities for business partnerships and collaboration. These issues hampered the market growth for a while. Moreover, in several under-developing nations, a wide number of people are unable to adopt automotive brake systems for their vehicles due to their high-price costs. Some key players are very popular. Hence, they make high-quality brake systems with the help of advanced technologies. Thus, innovative products like this could benefit their consumers but are expensive in the global market. Furthermore, the demand for both passenger cars and commercial vehicles is directly tied to the growth of the automotive braking system industry. Additionally, recent technical developments like ABS and regenerative braking are anticipated to have a favorable effect on the global automotive braking system market.

Based on brake type, the global automotive brake system market is segmented into disc and drum. The disc segment held a large share of the market over the past few years. This segment is also anticipated to hold a strong position and is projected to accelerate market growth during the upcoming years. Most notably, compared to rim brakes, disc brakes offer improved braking control. In many situations, they enable drivers to stop more quickly, precisely, in control, and at the desired pace. The disc brake segment is growing even faster owing to its connectivity with other cutting-edge systems. On the other hand, the drum brake system is expected to become the second largest segment over the upcoming years due to its rising demand. Drum brakes have a larger friction contact surface than a disc, thus they last longer. Manufacturing drum brakes are less expensive than disc brakes. Drum brakes towards the back produce less heat.

In terms of vehicle type, the market is segmented into commercial cars and passenger cars. The passenger car segment accounted for the largest share of the market. Due to rising populations, more disposable income, and urbanization, the demand for passenger cars is rising. The market for brake systems is mostly driven by government regulations. For instance, governments all over the world have been urged to adopt and apply sophisticated braking systems by establishing their local NCAPs as a result of the New Car Assessment Program (NCAP), which was first established by the US in 1978 to promote road and vehicle safety. Manufacturers frequently create more effective braking systems. The principal market share and growth of the passenger car are mostly influenced by ADAS.

By technology type, the ABS or antilock braking system category accounted for the larger share of the market. This category is also expected to accelerate market growth in the future. The strong drive by several auto industry groups to compel the deployment of ABS in strategic areas is what has led to the evolution of ABS technology. Similarly, electronic stability control technology is gaining popularity due to perceptions of its advantages in regaining vehicle control in an emergency. However, the traction stability control segment is also projected to hold a major share of the market. Through the application of braking pressure by ABS and throttle control, traction control prevents wheel spin. Since 2012, these technologies have been required in consumer automobiles in the US. Therefore, both of these segments are estimated to propel market growth during the forecast period.

Geographically, the Asia-Pacific region holds the major share of the market and is anticipated to drive market growth during the forecast period. Over the past few years, the industry has been driven by the availability of low-priced labor and raw materials, which allow businesses in the region to offer significant cost reductions. Additionally, the center of the car manufacturing industry is located in nations like China and India, among others. The market is anticipated to develop as a result of the increased popularity of automotive brake systems and an increase in sales of luxury and premium vehicles. Moreover, North America is also expected to become the second-fastest market. Most of the key players are situated in this region which is a plus point for the market growth.

According to the study, key players such as Aisin (Japan), Akebono Brake Industry (Japan), Continental AG (Germany), Hitachi (Japan), Haldex (Sweden), Knorr-Bremse (Germany), Mando Corporation (South Korea), Nissin Kogyo (Japan), Nuova Fourb SRL (Italy), Newfold Digital (U.S), Robert Bosch (Germany), TRW Automotive (U.S), Wabco (U.S), Zeppelin-Stiftung (Germany), among others are leading the global automotive brake system market.

Scope of the Report:

| Report Coverage | Details |

| Market Size in 2021 | US$ 49.2 Billion |

| Market Volume Projection by 2032 | US$ 90.4 Billion |

| Forecast Period 2022 to 2032 CAGR | 5.4% |

| Base Year: | 2021 |

| Historical Data | 2019, 2020 and 2021 |

| Forecast Period | 2022 to 2032 |

| Segments covered |

By Brake Type: Disc & Drum By Vehicle Type: Commercial Cars & Passenger Car By Technology Type: Antilock Braking System, Electrical Stability Control, Traction Stability Control & Electronic Brake-force Distribution |

| Geographies covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Companies covered | Aisin (Japan), Akebono Brake Industry (Japan), Continental AG (Germany), Hitachi (Japan), Haldex (Sweden), Knorr-Bremse (Germany), Mando Corporation (South Korea), Nissin Kogyo (Japan), Nuova Fourb SRL (Italy), Newfold Digital (U.S), Robert Bosch (Germany), TRW Automotive (U.S), Wabco (U.S), Zeppelin-Stiftung (Germany) & Others |

The Global Automotive Brake System Market Has Been Segmented Into:

The Global Automotive Brake System Market – by Brake Type:

- Disc

- Drum

The Global Automotive Brake System Market – by Vehicle Type:

- Commercial Cars

- Passenger Car

The Global Automotive Brake System Market – by Technology Type:

- Antilock Braking System

- Electrical Stability Control

- Traction Stability Control

- Electronic Brake-force Distribution

The Global Automotive Brake System Market – by Regions:

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe Countries

Asia-Pacific

- India

- China

- Japan

- South Korea

- Australia

- Rest of Asian Countries

LAMEA

- Brazil

- Saudi Arabia

- Rest of LAMEA

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing