China Baby Food Market, (By Food Types: Food Preparation, Bottle Preparation Organic Baby Food, Non-Organic Baby Food & Others. By Distribution: Offline, Online & Others By Region - China) -Industry Analysis, Growth, Trends & Forecast, 2022 to 2032

Report Type : Syndicate Report

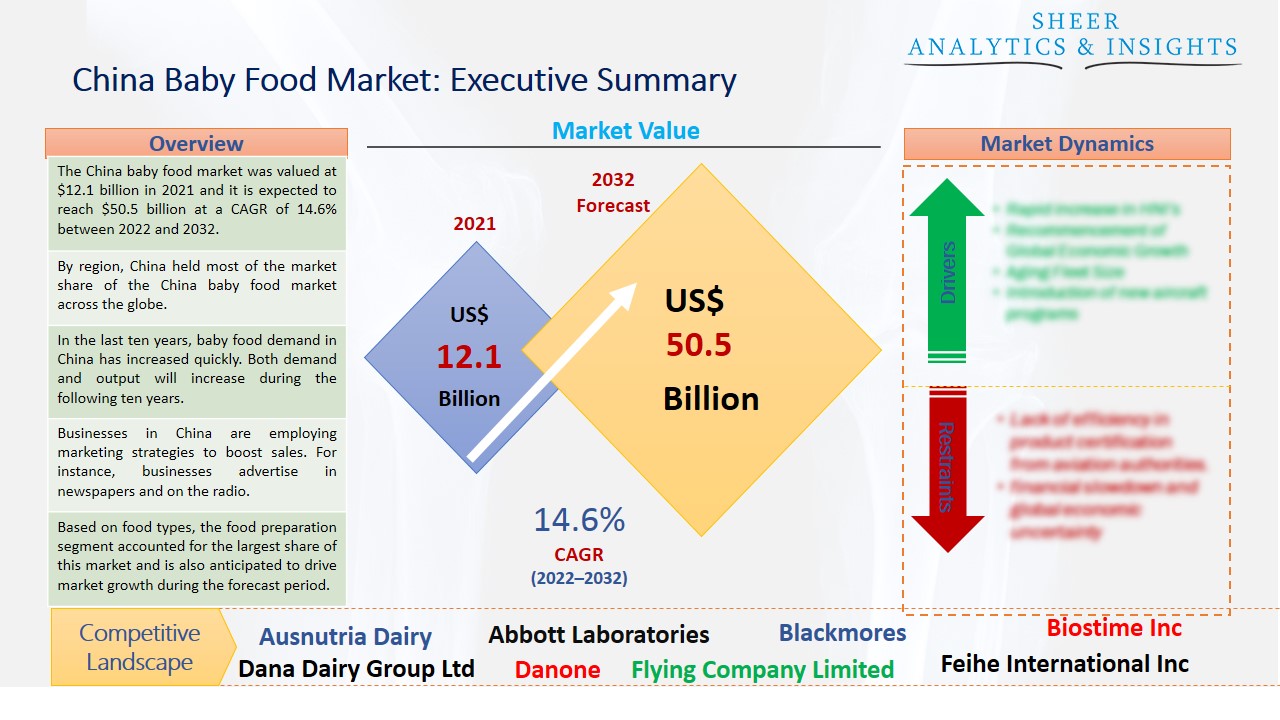

The China baby food market was valued at $12.1 billion in 2021 and it is expected to reach $50.5 billion at a CAGR of 14.6% between 2022 and 2032. Other significant factors projected to propel the market in the future years include the rising demand for instant milk & protein formulae, energy-boosting supplements, and ready-to-eat baby food products including all essential proteins & dietary supplements to guarantee optimal baby growth.

By region, China held most of the market share of the China baby food market across the globe.

Food producers must make sure that the market for healthy infant food is appropriately regulated, provides a bio-available combination of nutrients, and is free of dangerous ingredients. Macronutrients and micronutrients, including vitamins, minerals, and other nutrients, as well as carbohydrates, proteins, and fats. Furthermore, a shocking malnutrition rate among children under the age of five is thought to be the cause of 50% of their deaths, according to UNICEF estimates. Therefore, it is anticipated that hunger and malnutrition would present profitable growth prospects for the market's top competitors in developing and underdeveloped nations.

Source: SAI Research

Download Free PDF Sample Request

In the last ten years, baby food demand in China has increased quickly. Both demand and output will increase during the following ten years. The Chinese economy continues to expand at a fast rate, which has been fueled by long-term improvements in industrial output, import and export, consumer spending, and capital investment. The main element influencing the market for baby food producers is anticipated to be growing awareness about the right nutritional intake for toddlers and infants. Additionally, the increasing number of working-class women and the altering preference for a luxurious lifestyle has increased the demand for the product globally. Hence, these rising factors are expected to drive market growth during the forecast period from 2022 to 2032.

However, opportunities and problems always go hand in hand. The more promising market possibilities for supplementary foods and kid-friendly snacks are accompanied by undeveloped industry, undeveloped standards, and disappointed consumers. Product quality difficulties, regulatory monitoring, and a lack of consumer trust in domestic brands persist even in the nearly saturated baby formula market.

Businesses in China are employing marketing strategies to boost sales. For instance, businesses advertise in newspapers and on the radio. Through healthcare institutions and "milk nurses" employed by the corporations as sales agents, they give away free samples of infant drinks, particularly baby formula, to mothers and service providers. Moreover, companies can differentiate their products in the baby food industry by using environmentally friendly packaging and raising serious safety issues. Businesses aim to use recycled raw materials to design baby food product packaging. This aids the business's promotion of infant food items through eco-friendly marketing strategies. The infant food market is growing as a result of baby product innovation and aggressive marketing of baby food items. Baby food products are in higher demand online thanks to a shift in consumer behavior toward online buying.

Based on food types, the food preparation segment accounted for the largest share of this market and is also anticipated to drive market growth during the forecast period. To generate a flawless puree, these food preparation devices are used to steam solid food products like vegetables and fruits. Whole foods can also be ground without switching out the tool or container. However, organic baby food is also essential for many parents. This segment is also anticipated to boost market growth with more growth opportunities. Because their immune systems are still developing, babies and toddlers are more susceptible to the toxins found in genetically engineered food. Therefore, fresh food typically has a high concentration of important nutrients and gives newborns and toddlers superior nutrition.

Based on distribution type, the online segment is expected to gain more growth opportunities among a large number of consumers who are purchasing baby food products from various e-commerce websites or online shopping portals. A couple of years ago, during the time of COVID-19, most parents prefer buying food for their babies from online retailers. This has helped them a lot. The offline segment is also growing at present days. To reach as many customers as possible, several of the major retailers, like Wal-Mart Stores, Inc., IKEA, and Target Brands, Inc., are expanding their distribution centers around the world.

Geographically, Shanghai and Beijing both have been dominating the China baby food market over the past few years. These two major cities are expected to hold their dominant position during the forecast period from 2022 to 2032. Most of the offline retailer is established in these provinces which is another benefit for a large number of consumers. Moreover, several companies are focusing on expanding their business growth by implementing new strategies such as mergers and acquisitions as well as other business collaborations. This would also help the China baby food market to reach the largest growth in the future.

According to the study, key players such as Ausnutria Dairy (Hong Kong), Abbott Laboratories (U.S), Blackmores (Australia), Biostime Inc (China), Dana Dairy Group Ltd (Switzerland), Danone (Spain), Flying Company Limited (India), Feihe International Inc (China), Hero Group (Switzerland), HiPP (Germany), Modern Dairy Group (China), Mengniu Dairy (Hong Kong), Nestle (Switzerland), Reckitt (U.K), The Kraft Heinz (U.S), The a2 Milk Company (New Zealand), Yili Group (China), among others are leading the China baby food market.

Scope of the Report:

| Report Coverage | Details |

| Market Size in 2021 | US$ 12.1 Billion |

| Market Volume Projection by 2032 | US$ 50.5 Billion |

| Forecast Period 2022 to 2032 CAGR | 14.6% |

| Base Year: | 2021 |

| Historical Data | 2019, 2020 and 2021 |

| Forecast Period | 2022 to 2032 |

| Segments covered |

By Food Types: Food Preparation, Bottle Preparation Organic Baby Food, Non-Organic Baby Food & Others By Distribution Type: Offline Online & Others |

| Geographies covered |

China: Shanghai, Beijing, Zhejiang, Guangdong, Guangzhou & Other

|

| Companies covered | Ausnutria Dairy (Hong Kong), Abbott Laboratories (U.S), Blackmores (Australia), Biostime Inc (China), Dana Dairy Group Ltd (Switzerland), Danone (Spain), Flying Company Limited (India), Feihe International Inc (China), Hero Group (Switzerland), HiPP (Germany), Modern Dairy Group (China), Mengniu Dairy (Hong Kong), Nestle (Switzerland), Reckitt (U.K), The Kraft Heinz (U.S), The a2 Milk Company (New Zealand), Yili Group (China), among others |

The China Baby Food Market Has Been Segmented Into:

The China Baby Food Market – by Food Types:

- Food Preparation

- Bottle Preparation

- Organic Baby Food

- Non-Organic Baby Food

- Others

The China Baby Food Market – by Distribution Type:

- Offline

- Online

- Others

The China Baby Food Market – by Regions:

China

- Shanghai

- Beijing

- Zhejiang

- Guangdong

- Guangzhou

- Other

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing