China Digital Payment Market, (By Payment Type: Digital Wallets, Net Banking, Mobile Application, Others. By Enterprise Type: Small and Medium Enterprises, Large Enterprises. By End-User Type: BFSI, Healthcare, Media and Entertainment, Retail and E-Commerce, Transportation & Others.

Report Type : Syndicate Report

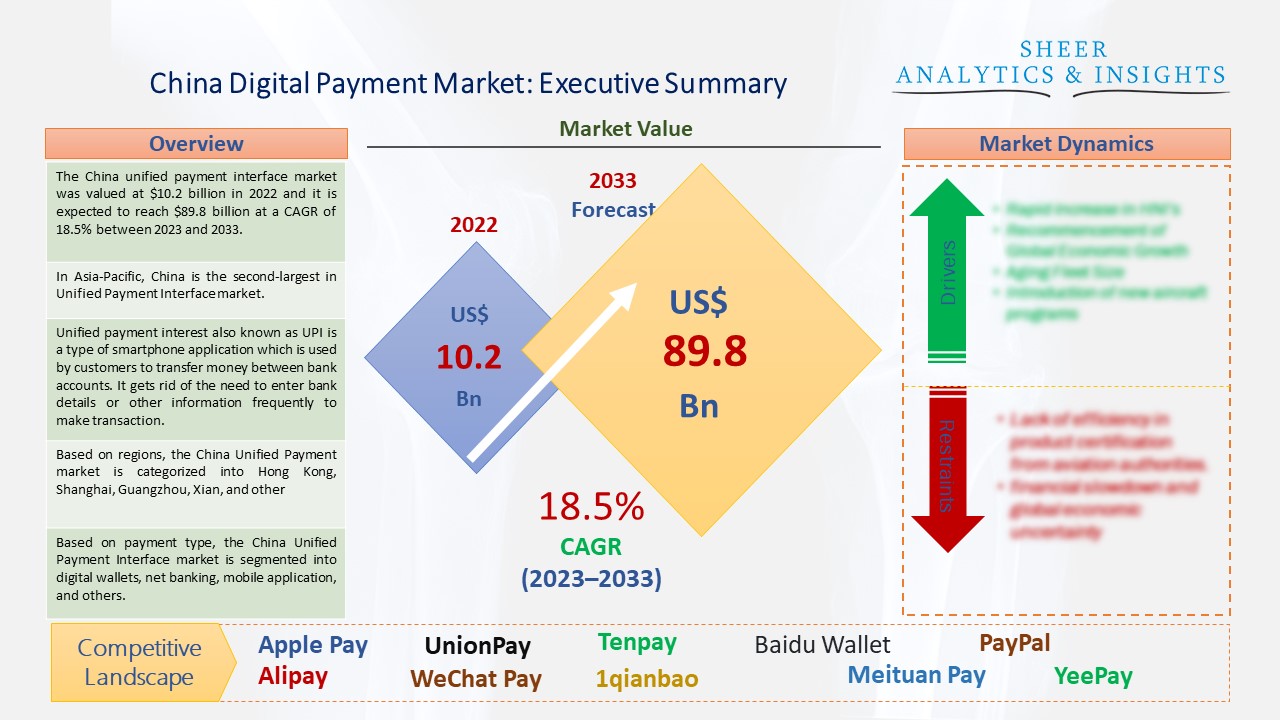

The China Digital Payment Market was valued at $10.2 billion in 2022 and it is expected to reach $89.8 billion at a CAGR of 18.5% between 2023 to 2033. Digital Payment also known as UPI is a system, through which one can transfer money between bank accounts across a single window. In addition, through this, any person can send and receive money or scan a quick response (QR) code to pay an individual or more than one person.

In Asia-Pacific, China is the second-largest in Digital Payment market.

When it comes to cashless payment or digital payment, China is certainly becoming more popular in the areas of online shopping as well as offline sectors such as restaurants, cafes, and stores. Alipay and WeChat Pay have become the most popular digital payment platforms among a large number of Chinese consumers. Furthermore, UnionPay is connected to major cities such as Hong Kong, and Shanghai, among others that have state-owned card payment networks. Key players across the China country have successfully rolled out their payment services for their customers. Users such as Chinese citizens and business persons are getting facilities regarding digital payment services from the Central Bank, which is providing UPI mode of transactions in recent years to their customers. China’s largest credit card brand named UnionPay has become the most popular financial technological services network. However, this method is helping Chinese customers in cashless transaction processes. Moreover, the current war scenario between Russia and Ukraine is becoming quite complicated and it has negatively affected the Russian financial position too. After Visa and MasterCard have suspended operations in Russia, China is also withdrawing the facilities of UnionPay from the country. This is the latest example of Chinese key players and they are growing wary of doing business in Russia.

Source: SAI Research

Download Free PDF Sample Request

Based on payment type, the China Digital Payment market is segmented into digital wallets, net banking, mobile application, and others. Digital payment and mobile application segments are growing faster due to the increasing usage of mobile phones and payment applications among customers. People are using more internet connections these days due to the current situation of increasing cases of COVID-19. Based on enterprise type, the market is segmented into small, medium, and larger enterprises. Due to increasing sales of various essential items over the internet and offline shops such as malls and retails, the large enterprise segment is estimated to witness significant growth in the upcoming years. Based on end-user, the UPI market in China is categorized into BFSI, healthcare, media and entertainment, retail and e-commerce, transportation, and others. The BFSI segment is dominating the market over the last few years due to the rising demand for digital remittance for international and domestic transactions, which is encouraging various banks to adopt digital payment solutions.

Based on regions, the China Unified Payment market is categorized into Hong Kong, Shanghai, Guangzhou, Xian, and other provinces. Among these, the major cities such as Hong Kong and Shanghai are dominating the UPI market in China. Factors such as growing deployment and technological advancement are helping produce innovative mobile phones and digital applications which offer secure payment facilities to their users. Moreover, China is positioned to take the lead with the digital Yuan. Thus, China can use its digital Yuan to internationalize the RMB. Over the last few years, many Chinese customers are already using digital payment services to shop online and to pay in brick-and-mortar businesses. In these major cities, Chinese citizens can now pay their fares in digital Yuan by using UPI methods and scanning QR codes. Hence, this is projected to help the overall Digital Payment Market to gain more significant growth in upcoming years.

Chinese Government taking several initiatives by developing and promoting CBDC adoption. Major cities such as Xiamen and Guangzhou have joined the list of other cities that are implementing digital Yuan payments in their transportation network. Last year, Alibaba Group launched a brand new server chip, which would boost its cloud business and is designed for artificial intelligence applications and storage. The company has announced to launch of a new application that will create an online retail model. Through this app, the company would directly source, buy, store, and market goods. This will benefit the usage of UPI mode. A few months before, Huawei partnered with Aleta Planet and UnionPay to support digital mobile payment platforms. Users can make a transaction through UnionPay by conducting contactless and Quick Response Code payments and then can have also Huawei Wallet. This card would allow customers to pay, receive, and remit payments through the UnionPay network. China-based Company named JD.Com has deployed large screen shopping machines to support the customers' use of digital renminbi in offline scenarios such as hotels, restaurants, parks, and banks, among others. This machine would allow customers to use a JD account for purchasing products directly sold by JD using a digital RMB application. Hence, these new launches of several key players are projected to drive the China Digital Payment market during the forecast period from 2022 to 2032.

According to the study, key players such as Apple Pay, Alipay, WeChat Pay, UnionPay, BestPay, Tenpay, JD Wallet, Baidu Wallet, 1qianbao, Huawei Pay, PayPal, YeePay, Meituan Pay, among others are leading the China Digital Payment market.

Scope of the Report:

|

Report Coverage |

Details |

|

Market Size in 2022 |

US$ 10.2 billion |

|

Market Volume Projection by 2033 |

US$ 89.8 billion |

|

Forecast Period 2023 to 2033 CAGR |

18.5% |

|

Base Year: |

2022 |

|

Historical Data |

2020 and 2022 |

|

Forecast Period |

2023 to 2033 |

|

Segments covered |

By Payment Type: Digital Wallets, Net Banking, Mobile Application, Others By Enterprise Type: Small and Medium Enterprises, Large Enterprises By End-User Type: BFSI, Healthcare, Media and Entertainment, Retail and E-Commerce, Transportation & Others |

|

Geographies covered |

China: Hong Kong, Shanghai, Guangzhou, Xian & Other |

|

Companies covered |

Apple Pay, Alipay, WeChat Pay, UnionPay, BestPay, Tenpay, JD Wallet, Baidu Wallet, 1qianbao, Huawei Pay, PayPal, YeePay, Meituan Pay |

China Digital Payment Market Has Been Segmented Into:

China Digital Payment Market – by Payment Type:

- Digital Wallets

- Net Banking

- Mobile Application

- Others

China Digital Payment Market – by Enterprise Type:

- Small and Medium Enterprises

- Large Enterprises

China Digital Payment Market – by End-User Type:

- BFSI

- Healthcare

- Media and Entertainment

- Retail and E-Commerce

- Transportation

- Others

China Digital Payment Market – by Regions:

China

- Hong Kong

- Shanghai

- Guangzhou

- Xian

- Other

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing