Electric Vehicle Fluids Market, (By Fluid Type: Engine Oil, Coolants, Transmission Fluids, Greases & Others. By Vehicle Type: Passenger Car & Commercial Car & Others. By Region - North America, Europe , Asia-Pacific , LAMEA) - Global Market Analysis, Growth, Trends & Forecast, 2022 to 2032

Report Type : Syndicate Report

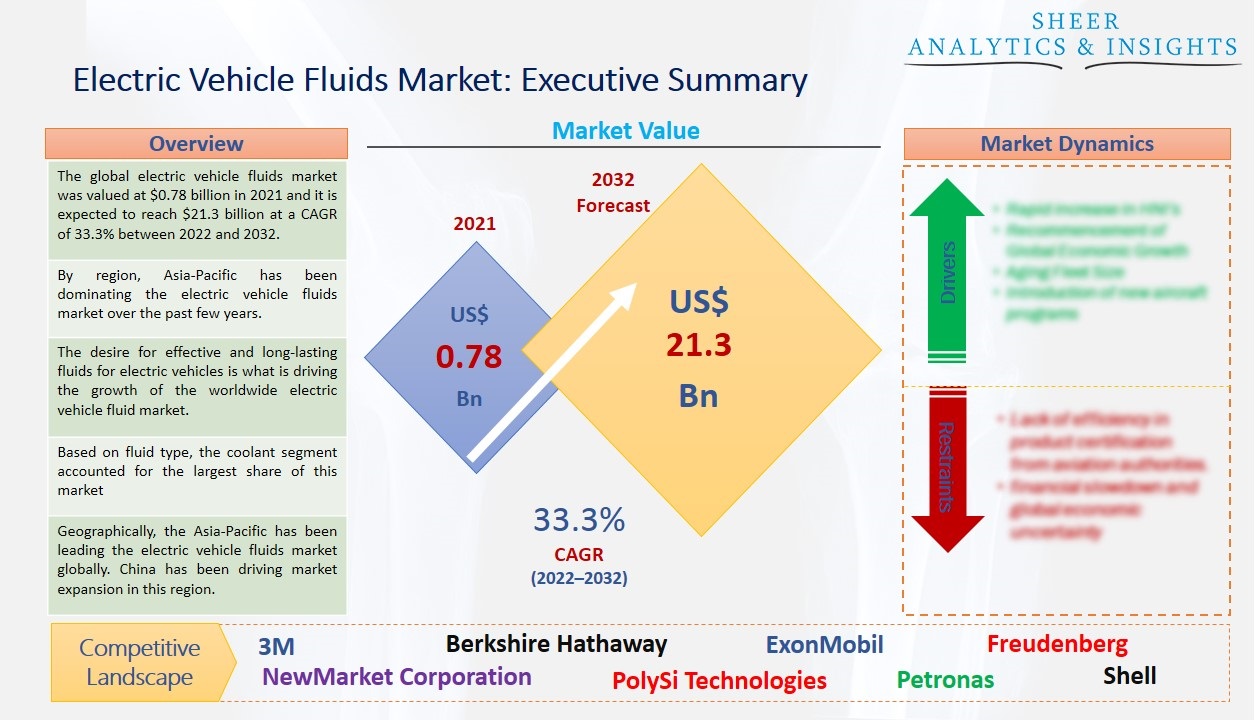

The global electric vehicle fluids market was valued at $0.78 billion in 2021 and it is expected to reach $21.3 billion at a CAGR of 33.3% between 2022 and 2032. The increased demand for Evs as a result of rising gasoline prices, rising pollution levels, and falling battery prices is the main factor influencing the need for electric vehicle fluids. Additionally, governments in different nations are putting different rules into effect to restrict the hazardous emissions from vehicles.

By region, Asia-Pacific has been dominating the electric vehicle fluids market over the past few years.

Major strides are still being made by electric vehicles in the field of personal transportation. A few original equipment makers, at least, aren't yet sure that the market is supplying the goods they're looking for. According to industry sources, the majority of EVs run on standard fluids designed for cars with solely internal combustion engines. These sources, therefore, refrain from claiming that the EV lubes currently available do not provide differentiated performance, but they do maintain that they do not yet provide enough of what EVs require to make use of them worthwhile.

Source: SAI Research

Download Free PDF Sample Request

The desire for effective and long-lasting fluids for electric vehicles is what is driving the growth of the worldwide electric vehicle fluid market. The battery system and e-motors, for example, produce a lot of heat when an electric car is operating. Additives and dielectric characteristics are added to new electric car lubricants to make them suitable for electric vehicle mechanisms. Grease, heat transfer fluid, drives system fluid, and brake fluid is the primary fluid types used to improve electric vehicle applications. When an electric vehicle is in use, the battery system and electric motor produce heat, and it is anticipated that the development of more effective thermal cooling systems will assist the market's future expansion.

Growth of the OEM segment is anticipated to be fueled by increased collaboration between automotive OEMs and major fluid suppliers to offer fluids for their electric vehicles to enhance the driving experience. Further encouraging the growth of the electric vehicle fluid lubricants market is anticipated in the future is the increased emphasis on electric vehicle manufacturing by automakers in developing nations. BEVs may not require conventional engine oils, but all EVs still need a variety of lubricants, fluids, and greases, especially when one takes into account hybrids that still include ICEs. Many of those lubricants must meet the same performance standards as regular cars.

Government initiatives to lessen reliance on fossil fuels and reduce pollution have made electric vehicles one of the automotive industry's fastest-growing categories. They are one of the fastest-growing segments even though they only represent a small portion of the dominant automobile industry today. Government regulations that are strict present a significant market potential for suppliers of fluids for electric vehicles. Governments in several nations now view the carbon emissions from ICE automobiles as a danger. As a result, the role of EVs in meeting regulations has increased due to the gradual tightening of fuel economy and tailpipe CO2 standards.

Based on fluid type, the coolant segment accounted for the largest share of this market and is also anticipated to drive the growth of the market during the forecast period from 2022 to 2032. This is because the coolant used in electric cars has poor electrical conductivity throughout its lifetime. Additionally, the fastest-growing product category for electric vehicles throughout the forecast period is anticipated to be coolants, which are used to control the temperature of the battery pack and other electronic components. On the other hand, the engine oil category is also increasing. This segment is also expected to lead the market over the forecast period. This is because hybrid electric vehicles have a high need for engine oil during first and servicing fills. Engine oil is consumed extensively since it has a much shorter replacement interval than other fluids used in electric vehicles.

In terms of vehicle type, the passenger car segment holds most of the market share. Electric vehicles feature motor speeds of up to 15,000 rotations per minute and significant power flow variations. They need a variety of fluids, including oil for the electric vehicle's gear reducer, which serves as its transmission and oil specifically for the electric motor if the manufacturer wants to increase cooling. Additionally, the largest segment, passenger vehicles, is anticipated to grow throughout the forecast period as a result of rising global demand for electric passenger vehicles, which is being fueled by supportive government initiatives to electrify transportation fleets, as well as rising demand for zero-emission vehicles in the e-commerce and logistics sectors for the environmentally friendly vehicle.

Geographically, the Asia-Pacific has been leading the electric vehicle fluids market globally. China has been driving market expansion in this region. Due to the enormous volume of electric vehicles produced in this nation, demand for electric vehicle fluid products has increased. In addition, encouraging government regulations to reduce pollution and the infrastructure for making batteries for electric vehicles boost the expansion of electric car products. Due to their expanding middle class and young population, nations like India, South Korea, and Japan also assist in market growth. On the other hand, Europe is also expected to become the second-largest market across the globe. Due to government laws, investments, subsidies, tax breaks, and other incentives, there is a high demand for electric vehicles in this region, which is fostering the expansion of electric vehicle fluids there.

According to the study, key players such as 3M (U.S), Berkshire Hathaway (U.S), BP (U.K), Dober (U.S), ExonMobil (U.S), ENEOS Holdings (Japan), Freudenberg (Germany), FUCHS (Germany), Infineum (Netherlands), Ministry of Energy (Thailand), M&I Materials Limited (U.K), Motul (France), NewMarket Corporation (U.S), PolySi Technologies (U.S), Petronas (Malaysia), Panolin (Switzerland), Repsol (Spain), Shell Plc (U.K), TotalEnergies (France), ValvoLine (U.S), among others are leading the global electric vehicle fluids market.

Scope of the Report:

| Report Coverage | Details |

| Market Size in 2021 | US$ 0.78 Billion |

| Market Volume Projection by 2032 | US$ 21.3 Billion |

| Forecast Period 2022 to 2032 CAGR | 33.3% |

| Base Year: | 2021 |

| Historical Data | 2019, 2020 and 2021 |

| Forecast Period | 2022 to 2032 |

| Segments covered |

By Fluid Type: Engine Oil, Coolants, Transmission Fluids, Greases & Others By Vehicle Type: Passenger Car & Commerc |

| Geographies covered |

North America, Europe, Asia-Pacific, LAMEA |

| Companies covered | 3M (U.S), Berkshire Hathaway (U.S), BP (U.K), Dober (U.S), ExonMobil (U.S), ENEOS Holdings (Japan), Freudenberg (Germany), FUCHS (Germany), Infineum (Netherlands), Ministry of Energy (Thailand), M&I Materials Limited (U.K), Motul (France), NewMarket Corporation (U.S), PolySi Technologies (U.S), Petronas (Malaysia), Panolin (Switzerland), Repsol (Spain), Shell Plc (U.K), TotalEnergies (France), ValvoLine (U.S), among others. |

The Global Electric Vehicle Fluids Market Has Been Segmented Into:

The Global Electric Vehicle Fluids Market – by Fluid Type:

- Engine Oil

- Coolants

- Transmission Fluids

- Greases

- Others

The Global Electric Vehicle Fluids Market – by Vehicle Type:

- Passenger Car

- Commercial Car

- Others

The Global Electric Vehicle Fluids Market – by Regions:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The U.K.

- France

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- India

- China

- Japan

- Australia

- Rest of Asia Pacific

- LAMEA

- Middle East

- Saudi Arabia

- UAE

- Others

- Latin America

- Brazil

- Chile

- Others

- Africa

- South Africa

- Egypt

- Others

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing