Erythropoietin Drugs Market, (By Drug Type: Biologics, Biosimilar & Others. By Application Type: Hematology, Cancer, Renal Diseases, Neurology & Others. By Region - North America, Europe , Asia-Pacific , LAMEA) - Global Market Analysis, Growth, Trends & Forecast, 2022 to 2032

Report Type : Syndicate Report

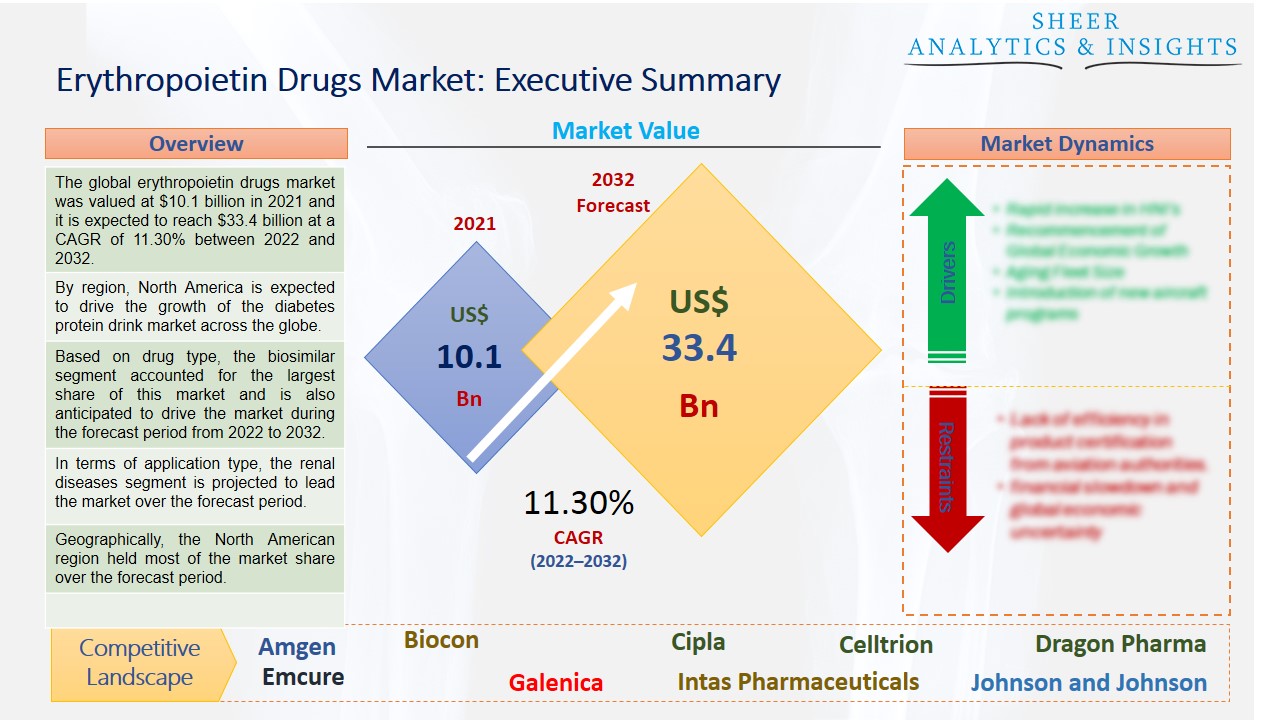

The global erythropoietin drugs market was valued at $10.1 billion in 2021 and it is expected to reach $33.4 billion at a CAGR of 11.30% between 2022 and 2032. Hematopoietic medications that promote erythropoiesis, or the formation of RBC in the bone marrow, include erythropoietin. This glycoprotein medication aids in the treatment of several illnesses, including anemia, AIDS, cancer, and several chronic conditions such as renal disease and anemia. The market size for erythropoietin drugs is growing as cancer cases rise.

By region, Asia-Pacific holds the highest share of this market across the globe.

Red blood cells are produced with EPO. Your hemoglobin levels increase as your red blood cell count increases. Red blood cells include the protein hemoglobin, which aids in the blood's ability to deliver oxygen throughout the body. The bone marrow is where red blood cells are made. The body maintains a sufficient level of erythropoietin, a hormone generated by the kidney, to create red blood cells. Additionally, when a person's blood does not contain enough hemoglobin, anemia develops. Anemia can have many distinct causes. For instance, the body's failure to create enough EPO to form red blood cells might result in anemia.

Source: SAI Research

Download Free PDF Sample Request

The rise of the erythropoietin medicine industry has been energized by the discovery of novel and cutting-edge medications as well as the government's numerous initiatives and encouragement of additional research activities. It has been discovered that EPO medications are highly sought-after for anemia brought on by chemotherapy. Hence, these are projected to propel the market growth during the forecast period. Furthermore, some pharmaceutical companies have approved the widespread use of these EPO medications for ART-induced anemia, which is particularly common in HIV patients. The government has implemented several programs to improve the population's access to healthcare, hence boosting market size and erythropoietin medicine market value.

Growth in erythropoietin drug market trends for commercializing medications that are available for reimbursement purposes is advantageous for regulating governmental regulations that increase public knowledge of the advantages of the therapeutic use of EPO medications and contribute to market expansion. Population growth and a rise in the rate of biologics are expanding the market potential. As a result, it is anticipated that these key aspects will expand this market's potential for growth.

Based on drug type, the biosimilar segment accounted for the largest share of this market and is also anticipated to drive the market during the forecast period from 2022 to 2032. Biosimilars are anticipated to acquire popularity soon for the treatment of anemic disorders since they are simple to adapt and improve, affordable, and take less time to receive approval than biologics. In comparison to biologics, these categories are also simpler to produce, more affordable and require less time for approval. Throughout the projection period, the segment expansion is anticipated to be fueled by these related benefits. However, the biologics segment is also anticipated to drive market growth during the forecast period from 2022 to 2032.

In terms of application type, the renal diseases segment is projected to lead the market over the forecast period. The U.S. FDA approved Epogen, the first erythropoietin medication, for the management of anemic indications resulting from CKD. Due to the rising incidence of cancer all over the world, the cancer segment is also anticipated to develop at the quickest rate. The cancer category is expected to increase the fastest due to the rising number of cancer cases in the world. Chemotherapy for cancer patients involves giving them drugs that reduce their red blood cell count.

Geographically, the North American region held most of the market share over the forecast period and is also projected to hold its dominant position throughout the forecast period from 2022 to 2032. The province's improvement can be linked to some factors, including the increasing acceptance of erythropoietin medications, government incentives granted for research on chronic illnesses, such as grants for creative work, drug restrictions, tax breaks, and fee exemptions, among others. Additionally, the proliferation of non-governmental groups like the Renal Association, which works to disseminate information on the most effective treatments for CKD, is boosting the market growth. On the other side, the Asia-Pacific region is also expected to become the second largest market in the future due to the establishment of several key players which are focusing on expanding their business growth by creating mergers and acquisitions.

According to the study, key players such as 3SBio (China), Amgen (U.S), Biocon (India), Cipla (India), Celltrion (South Korea), Dragon Pharma (U.S), Emcure (India), Galenica (Switzerland), Intas Pharmaceuticals (India), Johnson and Johnson (U.S), Kirin Holdings (Japan), LG Corp (South Korea), Nidda Healthcare Holding (Germany), Novartis (Switzerland), Pfizer (U.S), Roche Holding (Switzerland), Sihuan Pharmaceuticals (China), Sun Pharmaceuticals (India), Teva Pharmaceuticals (Israel), Uni-Bio Group (Hong Kong), among others are leading the global erythropoietin drugs market.

Scope of the Report:

| Report Coverage | Details |

| Market Size in 2021 | US$ 10.1 Billion |

| Market Volume Projection by 2032 | US$ 33.4 Billion |

| Forecast Period 2022 to 2032 CAGR | 11.3% |

| Base Year: | 2021 |

| Historical Data | 2019, 2020 and 2021 |

| Forecast Period | 2022 to 2032 |

| Segments covered |

By Drug Type: Biologics, Biosimilar & Others By Application Type: Hematology, Cancer, Renal Diseases, Neurology & Others |

| Geographies covered |

North America, Europe, Asia-Pacific, LAMEA |

| Companies covered | 3SBio (China), Amgen (U.S), Biocon (India), Cipla (India), Celltrion (South Korea), Dragon Pharma (U.S), Emcure (India), Galenica (Switzerland), Intas Pharmaceuticals (India), Johnson and Johnson (U.S), Kirin Holdings (Japan), LG Corp (South Korea), Nidda Healthcare Holding (Germany), Novartis (Switzerland), Pfizer (U.S), Roche Holding (Switzerland), Sihuan Pharmaceuticals (China), Sun Pharmaceuticals (India), Teva Pharmaceuticals (Israel), Uni-Bio Group (Hong Kong) & Others |

The Global Erythropoietin Drugs Market Has Been Segmented Into:

The Global Erythropoietin Drugs Market – by Drug Type:

- Biologics

- Biosimilar

- Others

The Global Erythropoietin Drugs Market – by Application Type:

- Hematology

- Cancer

- Renal Diseases

- Neurology

- Others

The Global Erythropoietin Drugs Market – by Regions:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- U.K.

- France

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- India

- China

- Japan

- Australia

- Rest of Asia Pacific

- LAMEA

- Middle East

- Saudi Arabia

- UAE

- Others

- Latin America

- Brazil

- Chile

- Others

- Africa

- South Africa

- Egypt

- Others

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing