Fuel Cell Forklift Market, (By Type: PEMFC Forklift, DMFC Forklift & Others. By Application Type: Warehouse Logistics, Dock Handling & Others By Region - North America, Europe , Asia-Pacific , LAMEA) - Global Market Analysis, Growth, Trends & Forecast, 2022 to 2032

Report Type : Syndicate Report

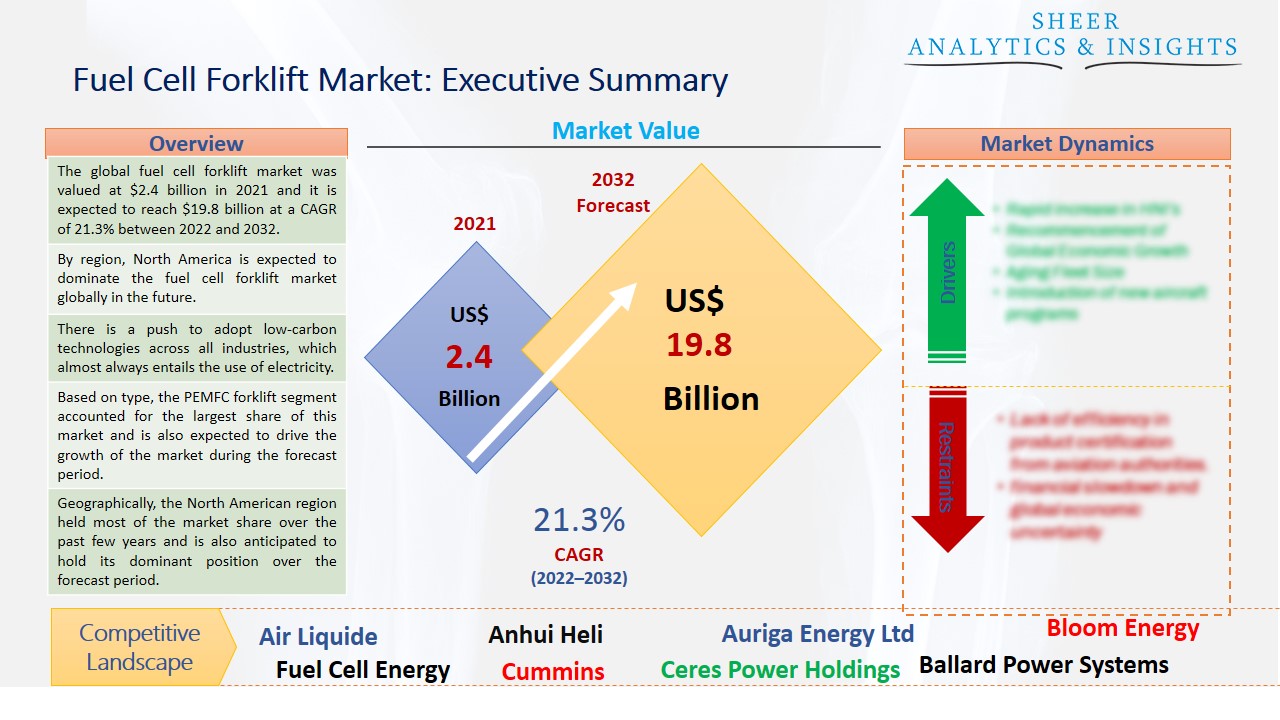

The global fuel cell forklift market was valued at $2.4 billion in 2021 and it is expected to reach $19.8 billion at a CAGR of 21.3% between 2022 and 2032. The global fuel cell forklift market is being driven by e-commerce business expansion as well as increased infrastructural investment. One of the main causes causing the expansion is the rise in demand for alternative energy sources.

By region, North America is expected to dominate the fuel cell forklift market globally in the future.

Electric forklifts are becoming more and more popular, and manufacturers are working hard to find ways to increase their performance and run time so that they can compete with or perhaps outperform their internal combustion engine counterparts. One practical alternative energy source is hydrogen. Hydrogen fuel cells have been demonstrated to be a viable alternative to the current conventional means of powering machinery and equipment, whether it be for material handling equipment, cars, or even industries and workplaces.

There is a push to adopt low-carbon technologies across all industries, which almost always entails the use of electricity. Because of this, there is a greater need for electricity and the infrastructure needed to deliver it. For example, consider how many electric car chargers have been erected in transportation hubs. When choosing the best energy system for industrial trucks, factors like the area needed for refueling or charging, energy costs, and environmental compatibility are taken into consideration in addition to the application requirements. Forklifts that must work an extended shift may need to have their batteries changed in the middle of the shift to ensure that they can keep going until the end of the designated shift. Therefore, if many battery changes are required at the same time, removing multiple forklifts and operators from operations for a lengthy period, can have a significant overall impact on operations.

Source: SAI Research

Download Free PDF Sample Request

As part of the battery charging process, current forklift batteries must be degassed; once more, improper ventilation of the battery charging area or room can result in a build-up of degassing gases that could be harmful to worker health. Moreover, because batteries don't need to be charged, hydrogen forklifts eliminate the health dangers connected to chemicals and off-gassing. Hence, these rising factors are expected to drive the growth of the fuel cell forklift market globally over the forecast period from 2022 to 2032.

Based on type, the PEMFC forklift segment accounted for the largest share of this market and is also expected to drive the growth of the market during the forecast period. These batteries-like fuel cells transmit electrons along an electrical route using a cathode, anode, and electrolyte to power the forklift. Additionally, because the performance of fuel-cell-powered forklifts is less sensitive to temperature than that of some types of lithium batteries, they are frequently utilized in refrigerated warehouses.

In terms of application type, the warehouse logistics segment holds most of the market share and is anticipated to accelerate the market growth over the forecast period from 2022 to 2032. In warehouse logistics, these forklift trucks have been employed as an alternative to battery-powered forklift trucks. Additionally, the organization uses these forklifts from the beginning of planning to increase operational productivity. It's a fantastic idea to warehouse your items to keep them secure and out of harm's way. The chances of damaged items increase significantly when businesses ship products from one warehouse to another. The process often entails shipping products from the business to a distribution center to await delivery.

Geographically, the North American region held most of the market share over the past few years and is also anticipated to hold its dominant position over the forecast period. Forklift use is increasing significantly in North America, partly as a result of the manufacturing sector's expansion. The market for hydrogen fuel cell forklifts in North America is dominated by the United States and Canada. On the other side, it is also projected that the Europe region will expand in the future. Germany, the United Kingdom, France, Russia, and other important nations are included in the list of key nations included under Europe.

According to the study, key players such as Air Liquide (France), Anhui Heli (China), Auriga Energy Ltd (U.K), Bloom Energy (U.S), Ballard Power Systems (Canada), Ceres Power Holdings (U.K), Cummins (U.S), Doosan (South Korea), Fuel Cell Energy (U.S), Johnson Matthey (U.K), Jungheinrich (Japan), KION Group (Germany), Mitsubishi Logisnext (Japan), Nel (Norway), Nedstack Fuel Cell Technology (Netherlands), NACCO Industries (U.S), Plug Power Inc (U.S), SFN CleanTech Investment Ltd (U.K), Toyota Group (Japan), among others are leading the global fuel cell forklift market.

Scope of the Report:

| Report Coverage | Details |

| Market Size in 2021 | US$ 2.4 Billion |

| Market Volume Projection by 2032 | US$ 19.8 Billion |

| Forecast Period 2022 to 2032 CAGR | 21.3% |

| Base Year: | 2021 |

| Historical Data | 2019, 2020 and 2021 |

| Forecast Period | 2022 to 2032 |

| Segments covered |

By Type: PEMFC Forklift, DMFC Forklift & Others The Global Fuel Cell Forklift Market – by Application Type: Warehouse Logistics, Dock Handling & Others |

| Geographies covered |

North America, Europe, Asia-Pacific, LAMEA |

| Companies covered | Air Liquide (France), Anhui Heli (China), Auriga Energy Ltd (U.K), Bloom Energy (U.S), Ballard Power Systems (Canada), Ceres Power Holdings (U.K), Cummins (U.S), Doosan (South Korea), Fuel Cell Energy (U.S), Johnson Matthey (U.K), Jungheinrich (Japan), KION Group (Germany), Mitsubishi Logisnext (Japan), Nel (Norway), Nedstack Fuel Cell Technology (Netherlands), NACCO Industries (U.S), Plug Power Inc (U.S), SFN CleanTech Investment Ltd (U.K), Toyota Group (Japan), among others. |

The Global Fuel Cell Forklift Market Has Been Segmented Into:

The Global Fuel Cell Forklift Market – by Type:

- PEMFC Forklift

- DMFC Forklift

- Others

The Global Fuel Cell Forklift Market – by Application Type:

- Warehouse Logistics

- Dock Handling

- Others

The Global Fuel Cell Forklift Market – by Regions:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The U.K.

- France

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- India

- China

- Japan

- Australia

- Rest of Asia Pacific

- LAMEA

- Middle East

- Saudi Arabia

- UAE

- Others

- Latin America

- Brazil

- Chile

- Others

- Africa

- South Africa

- Egypt

- Others

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing