Hard Carbon Material Market (By Type: Coal Tar Source, Natural Plant Source, Resin Source & Others. By Application: Power Battery, Digital Battery, Energy Storage Battery & Others. By Region) - Global Industry Analysis, Growth, Trends & Forecast, 2022 to 2032

Report Type : Syndicate Report

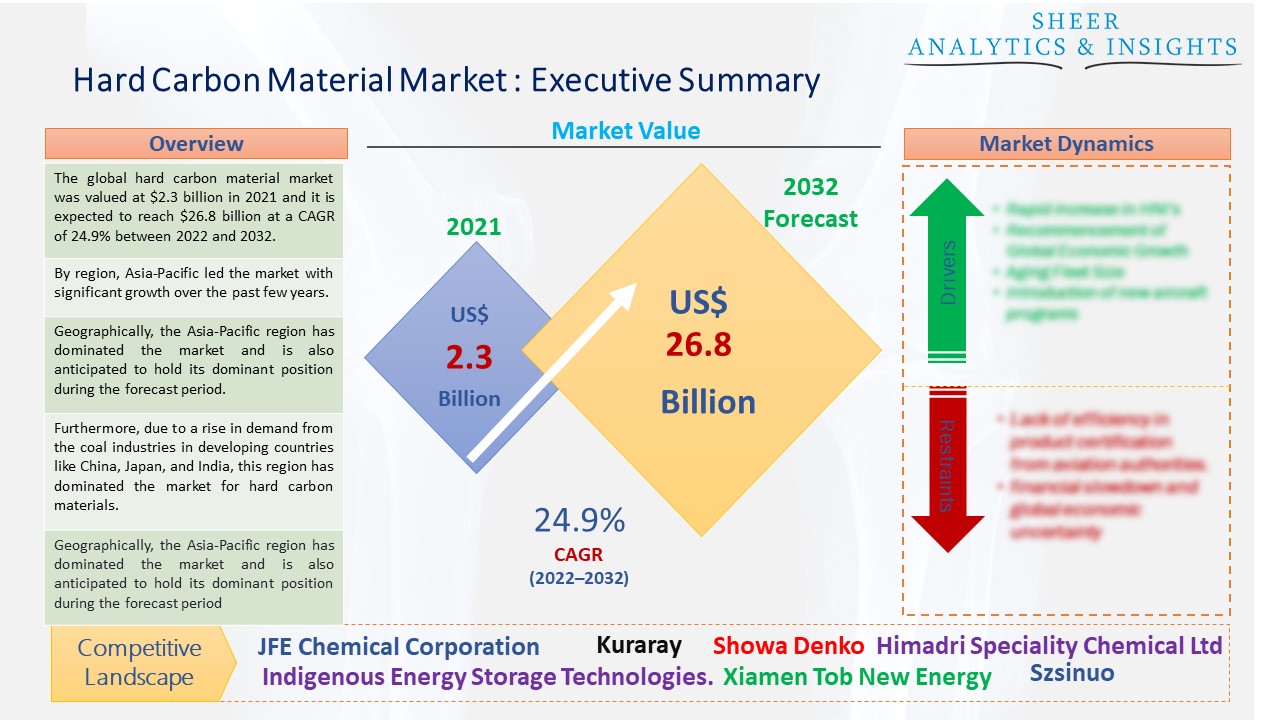

The global hard carbon material market was valued at $2.3 billion in 2021 and it is expected to reach $26.8 billion at a CAGR of 24.9% between 2022 and 2032. The hard carbon material market's competitive environment offers data on the total economic profit made by suppliers and companies, the sales and revenues produced in this industry, the global hard carbon material market share, a summary of the business organization, the introduction of new products, and market prospects.

By region, Asia-Pacific led the market with significant growth over the past few years.

By applying heat to the macroporous phenolic resin at various temperatures, hard carbon is created. We look at how temperature affects the hard carbon electrode's structure and characteristics in Na and K cells. Na cells' reversible capabilities rise as the heat-treatment temperature rises.

A wide range of commercial applications, including home storage, dependable power supply, and low-speed electric vehicles ranging from electric three-wheelers to trucks, have shown a substantial interest in sodium-ion batteries. Additionally, this chemistry is a great option to close the long-standing gap between lead-acid and lithium-ion batteries on the cost-per-performance curve due to its reduced cost, increased sustainability, ability to be discharged to zero volts during transportation, and drop-in manufacturing style.

Source: SAI Research

Download Free PDF Sample Request

Moreover, given recent industry developments like the purchase of Faradion by Reliance New Energy Solar Ltd for an organization, creating a sustainable supply chain for Na-ion battery materials is crucial. Due to their exceptional cost-effectiveness, hard carbon materials have been thought to have the greatest potential as anodes in commercial SIBs. However, further research is still needed due to their relatively poor performance in comparison to graphite in LIBs and the gloominess of the sodium storage mechanisms.

Based on type, the coal tar source segment accounted for the largest share of this market. Coal is the source of coal tar. It is a byproduct of the manufacturing of coal gas and coke, a solid fuel with high carbon content. To make refined chemicals and coal-tar products like creosote and coal-tar pitch, coal tar is predominantly used. Humans are primarily exposed to coal tars and coal-tar derivatives by inhalation, ingestion, and skin absorption. The manufacturing of coke, coal gasification, and aluminum can all expose workers to coal tars and coal-tar pitches. These benefits or advantages are estimated to propel the market growth in the future.

In terms of application type, energy storage battery holds most of the market share and is also anticipated to gain more growth opportunities for the hard carbon material market across the globe. A primary node for the entire grid, energy storage complements resources such as wind, solar, and hydropower as well as nuclear and fossil fuels, demand-side resources, and system efficiency assets. By storing inexpensive energy and using it later, energy storage can lower the cost of providing frequency regulation and spinning reserve services as well as balance out costs for customers. These advantages are predicted to accelerate market expansion.

Geographically, the Asia-Pacific region has dominated the market and is also anticipated to hold its dominant position during the forecast period due to the establishment of most of the key players in several countries of this region. Furthermore, due to a rise in demand from the coal industries in developing countries like China, Japan, and India, this region has dominated the market for hard carbon materials. The rise in hard carbon material in the Asia-Pacific is also due to the quick development of the chemical industry in this region's developing nations. On the other side, due to an increase in demand from the automobile industry, the North American region is also anticipated to overtake Europe as the second-largest market in the future. The second-largest market for back carbon products is the United States.

According to the study, key players such as JFE Chemical Corporation, Kuraray, Showa Denko, Szsinuo, Imerys S.A., Wuhan Bixidi Battery Material Co. Ltd., Indigenous Energy Storage Technologies Pvt. Ltd., Himadri Speciality Chemical Ltd, Xiamen Tob New Energy, and Stora Enso., among others are leading the global hard carbon material market.

Scope of the Report:

| Report Coverage | Details |

| Market Size in 2021 | US$ 2.3 Billion |

| Market Volume Projection by 2032 | US$ 26.8 Billion |

| Forecast Period 2022 to 2032 CAGR | 24.9% |

| Base Year: | 2021 |

| Historical Data | 2019, 2020 and 2021 |

| Forecast Period | 2022 to 2032 |

| Segments covered |

By Type: Coal Tar Source, Natural Plant Source, Resin Source & Others By Application Type: Power Battery, Digital Battery, Energy Storage Battery & Others |

| Geographies covered |

North America, Europe, Asia-Pacific, LAMEA |

| Companies covered | JFE Chemical Corporation, Kuraray, Showa Denko, Szsinuo, Imerys S.A., Wuhan Bixidi Battery Material Co. Ltd., Indigenous Energy Storage Technologies Pvt. Ltd., Himadri Speciality Chemical Ltd, Xiamen Tob New Energy, and Stora Enso., among others are leading the global hard carbon material market. |

The Global Hard Carbon Material Market Has Been Segmented Into:

The Global Hard Carbon Material Market – by Type:

- Coal Tar Source

- Natural Plant Source

- Resin Source

- Others

The Global Hard Carbon Material Market – by Application Type:

- Power Battery

- Digital Battery

- Energy Storage Battery

- Others

The Global Hard Carbon Material Market – by Regions:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The U.K.

- France

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- India

- China

- Japan

- Australia

- Rest of Asia Pacific

- LAMEA

- Middle East

- Saudi Arabia

- UAE

- Others

- Latin America

- Brazil

- Chile

- Others

- Africa

- South Africa

- Egypt

- Other

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing