India Cashfree Payments Market, By Segmentation (By Payment Type: Digital Currencies, Bank Cards, Digital Wallets, Net Banking, Points of Sales & Others. By Enterprise Type: Small and Medium Enterprises, Large Enterprises. By End-User Type: BFSI, Healthcare, Media and Entertainment, Retail and E-Commerce, Transportation & Others. By Geography – India) | Industry Size, Share, Research Reports, 2022-2032

Report Type : Syndicate Report

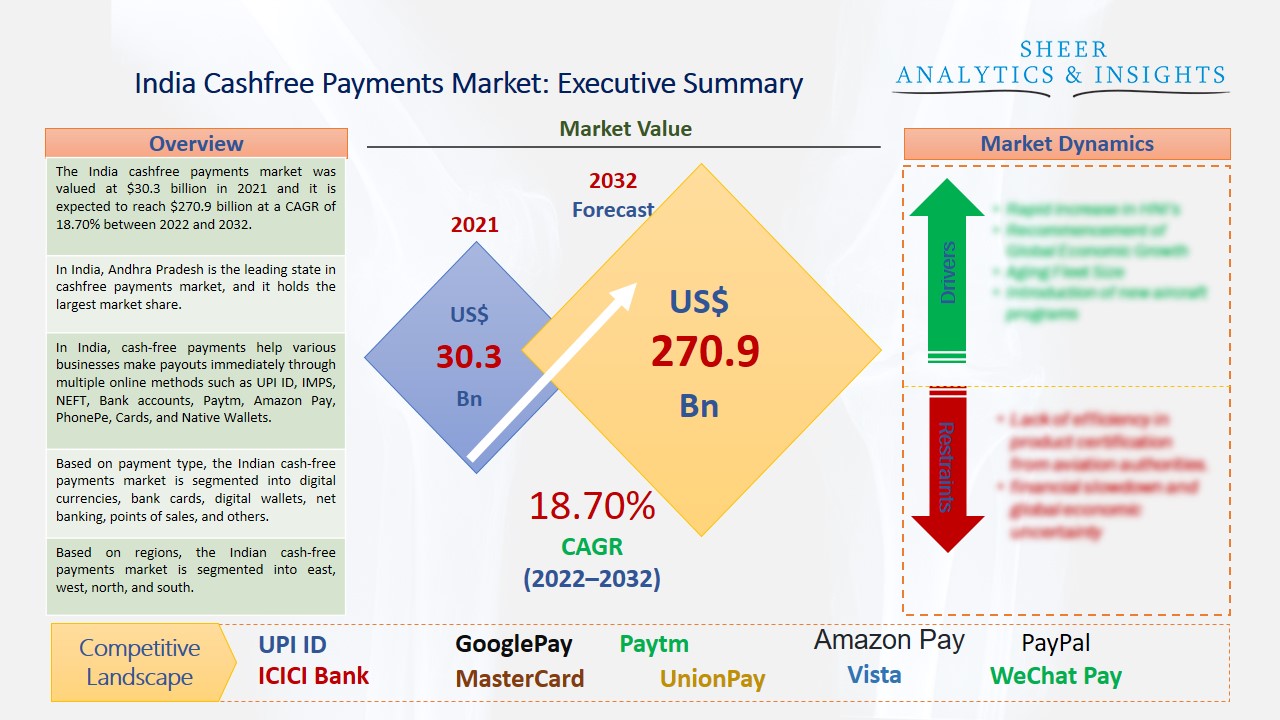

The India cashfree payments market was valued at $30.3 billion in 2021 and it is expected to reach $270.9 billion at a CAGR of 18.70% between 2022 and 2032. Cashfree payment is a type of digital payment. Customers can use this kind of system for online transactions such as payments received, payout transactions, and more. From small amounts to large amounts of money can be transferred into another bank account through various payment applications. This has made the money transfer very easy to use among various people including business persons and merchants.

In India, Andhra Pradesh is the leading state in cashfree payments market, and it holds the largest market share.

In India, cash-free payments help various businesses make payouts immediately through multiple online methods such as UPI ID, IMPS, NEFT, Bank accounts, Paytm, Amazon Pay, PhonePe, Cards, and Native Wallets. Moreover, customers can also transfer money on holidays. Additionally, these systems are highly reliable, scalable, and resilient, with risk mitigation features such as fraud detection, and API level security. Due to the reforms and growth have been observed in the Indian economy, interest in digital payments has increased among a large number of consumers. Thus, contactless payments have become the new normal across the country. Furthermore, in the last couple of years, during the time of the COVID-19 lockdown, people were needed to stay at their homes; hence it was very difficult for them to buy something and make cash payments. Therefore, digital payments have benefited them to make online payments through various mobile applications such as Paytm, PhonePe, GooglePay, and more. Due to these rising factors, the cash-free payments market in India is projected to gain huge growth during the forecast period. Other major factors such as increasing demand for smartphones among the young generation and growing usage of payment application is expected to drive the market growth during the upcoming years.

Source: SAI Research

Based on payment type, the Indian cash-free payments market is segmented into digital currencies, bank cards, digital wallets, net banking, points of sales, and others. The point of sales segment is dominating the market over the last few years. It holds maximum revenue share which has benefited the market overall. Point of sale is widely used by retail stores for processing transactions. Additionally, this segment provides several benefit such as fast checkout options, customized experience customers, and multiple payment options, which has been driven the market growth. Based on enterprise type, the market is categorized into small, medium, and large enterprises. The large enterprise segment has dominated the cash-free payments market across the country over the last few years. Due to the rising demand for cash-free payment solutions in large retail enterprises, customers are conducting payments through digital platforms. This has driven the market growth over the last few years. Based on end-user type, the market is segmented into BFSI, healthcare, media and entertainment, retail and e-commerce, transportation, and others. Among these, the BFSI category holds the maximum market share and it is expected to support the market during the forecast period.

Based on regions, the Indian cash-free payments market is segmented into east, west, north, and south. Among these, a South Indian state named Andhra Pradesh holds the largest share in the cash-free payments market across the country. Major factors such as the increasing deployment of technology, rising mobile and application usage among a large number of customers, and increasing online transactions have driven the market in this Andhra Pradesh state. The cash-free payments landscape in India has undergone several transformations in the last several years. Penetration of the internet into even remote villages and affordable smartphones has further added to cash-free payment momentum. Compared to other states in India, digital literacy has increased among the people from Andhra Pradesh, which has driven the cash-free payments market growth over the last few years. Therefore, it is expected to boost the market growth in the upcoming years.

Last year, BharatPe announced its foray into the Buy Now Pay Later (BNPL) segment, with the launch of PostPe. PostPe provides credit to customers. Additionally, customers can download the application and avail of interest-free credit limits up to rupees 10 lakhs. Furthermore, the company aims to facilitate a loan book of more than 23000 rupees on PostPe in the first twelve months for its lending partners. India-based Company Auras Inc is focusing to offer its customers and merchants a payment gateway to accept payments through cards and digital payments applications such as ApplePay. The company has claimed to have a patented technology that takes POS payments out of the scope of PCI. Furthermore, the company has included some important features such as P2P encryption, tokenization, and fraud prevention. It also provides EMV migration and chip acceptance solutions. RazorPay has launched the Current Account facility, which is designed for businesses, entrepreneurs, and entities that transact frequently. These bank accounts have no limits on the number of deposits and withdrawals. Customers can open a current account for free on RazorPayX, add beneficiaries and start transactions right after they sign up. Moreover, this company has launched a faster checkout feature, which is convenient for users to pay businesses with a faster checkout option as the leading Indian payments infrastructure giant pushes to gain a bigger slice of the world’s second-largest internet market. Therefore, these new cash-free payment launches are estimated to drive the market throughout the forecast period from 2022 to 2032.

According to the study, key players such as ACI Worldwide (U.S), Aurus Inc (India), Apple Inc (U.S), Alphabet Inc (U.S), Amazon Pay (U.S), Adyen (Netherlands), Alipay (China), BillDesk (India), BharatPe (India), Global Payments Inc (U.S), ICICI Bank (India), Instamojo (India), MasterCard (U.S), Novatti Group (Australia), One97 Communications (India), PayPal Holdings (Inc), Pine Labs (India), RazorPay (India), Stripe (U.S), Sage Pay Europe Limited (U.K), Vista Equity Partners (U.S), Visa Inc (U.S), WeChat Pay (China), WEX Inc (U.S), Walmart (U.S), among others are leading the India cashfree payments market.

Scope of the Report:

|

Report Coverage |

Details |

| Market Size in 2021 | US$ 30.3 billion |

| Market Volume Projection by 2032 | US$ 48.6 billion |

| Forecast Period 2022 to 2032 CAGR | 18.70% |

| Base Year: | 2021 |

| Historical Data | 2019, 2020 and 2021 |

| Forecast Period | 2022 to 2032 |

| Segments covered |

By Payment Type: Digital Currencies, Bank Cards, Digital Wallets, Net Banking, Points of Sales & Others By Enterprise Type: Small and Medium Enterprises, Large Enterprises By End-User Type: BFSI, Healthcare, Media and Entertainment, Retail and E-Commerce, Transportation & Others |

| Geographies covered |

India: East, West, North, South |

| Companies covered | ACI Worldwide (U.S), Aurus Inc (India), Apple Inc (India), Alphabet Inc (U.S), Amazon Pay (U.S), Adyen (Netherlands), Alipay (China), BillDesk (India), BharatPe (India), Global Payments Inc (U.S), Huawei Investment and Holdings (China), ICICI Bank (India), Instamojo (India), JD.Com (China), MasterCard (U.S), Novatti Group (Australia), One97 Communications (India), PayPal Holdings (Inc), Pine Labs (India), RazorPay (India), Stripe (U.S), Sage Pay Europe Limited (U.K), UnionPay (China), Vista Equity Partners (U.S), Visa Inc (U.S), WeChat Pay (China), WEX Inc (U.S), Walmart (U.S), among others |

India Cashfree Payments Market Has Been Segmented Into:

India Cashfree Payments Market – by Payment Type:

- Digital Currencies

- Bank Cards

- Digital Wallets

- Net Banking

- Points of Sales

- Others

India Cashfree Payments Market – by Enterprise Type:

- Small and Medium Enterprises

- Large Enterprises

India Cashfree Payments Market – by End-User Type:

- BFSI

- Healthcare

- Media and Entertainment

- Retail and E-Commerce

- Transportation

- Others

India Cashfree Payments Market – by Regions:

India

- East

- West

- North

- South

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing