India Passive Optical Network Market, (By Component Type: ONT, OLT. By Structure Type: GPON, EPON, WDM-PON. By Application Type: FTTx, Mobile Backhaul. By Region - India, China, Japa,n South Korea, North Korea) | Industry Size, Share, Analysis, Growth, and Forecast 2022-2032

Report Type : Syndicate Report

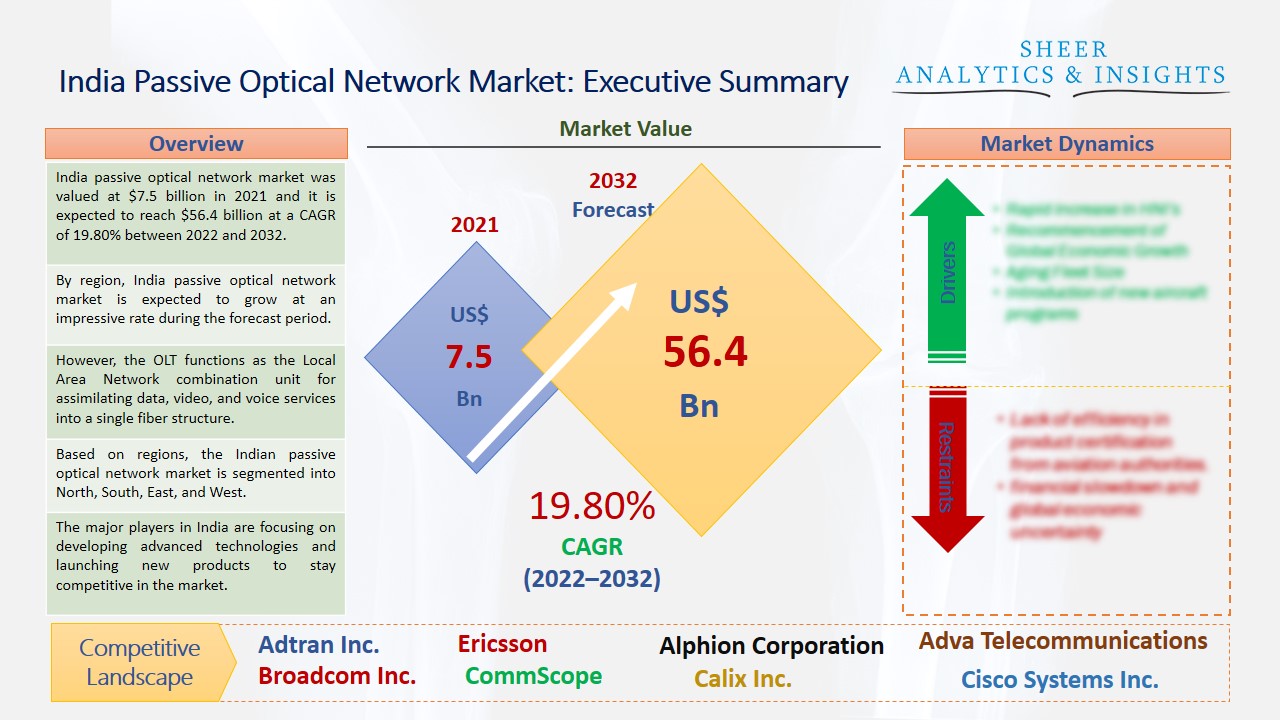

India passive optical network market was valued at $7.5 billion in 2021 and it is expected to reach $56.4 billion at a CAGR of 19.80% between 2022 and 2032. A passive optical network is a type of system which is generally used by telecommunications network providers that brings fiber optic cabling and signals to a large number of end-users. Furthermore, it consists of an optical line terminal at the communication company’s central office and many optical network units for nearby end customers.

By region, India passive optical network market is expected to grow at an impressive rate during the forecast period.

There are several benefits and limitations of passive optical networks such as these are cheaper to deploy compared to most alternative broadband delivery technologies, they do not require electrically powered midspan devices to operate, they use existing fiber optic, their upgrade paths are plentiful, and throughout rates are keeping up with alternative technologies, they are considered a secure broadband technology, and they can be transported over a relatively long distance, such as 20 kilometers, on a central office loop. Therefore, these major factors and benefits have driven the passive optical network market to gain significant growth in India. Another major factor such as the surge in the demand for establishing fiber-to-the-home and fiber-to-the-business and others due to the increasing digitalization across the globe is estimated to drive the market growth during the forecast period from 2022 to 2032. The Indian government is also supporting the market by promoting the growth in digital evolution, availability of funding for conducting research and development to improve performance, and increase applications of passive optical networks is estimated to boost the market growth.

Source: SAI Research

Based on components, the Indian passive optical network market is segmented into ONT and OLT. Both of these segments are expected to boost the market growth due to increasing demand and rapid adoption of optical network thermal and optical line thermal. OLT is placed at the central office, while the ONT is placed at the subscriber’s premises. However, the OLT functions as the Local Area Network combination unit for assimilating data, video, and voice services into a single fiber structure. The ONT terminates the passive optical network which provides different local service interfaces to the customers. Based on structures, the Indian passive optical network market is segmented into GPON, EPON, and WDM-PON. The GPON segment is estimated to have the largest revenue share, which would support the growth of the passive optical network market in India. Based on application type, the market is segmented into FTTx and mobile backhaul. Fiber to the x (FTTx) segment is estimated to have more revenue share due to the rising usage of broadband network architecture using optical fiber deployment. However, the other major factors such as high-speed internet connection, growing penetration of smart grids, e-governance services, and cloud computing are also expected to drive the demand for the passive optical network in upcoming years across India.

Based on regions, the Indian passive optical network market is segmented into North, South, East, and West. The increasing investment from both public and private sectors in R&D activities is further expected to create opportunities for the market in the upcoming years. In this country, the EPON category is expected to gain significant growth in the passive optical network market. This can be attributed to the data-intensive services such as video conferencing, voice over internet protocol, and others which are gradually increasing the demand for passive optical network in the Indian market.

The major players in India are focusing on developing advanced technologies and launching new products to stay competitive in the market. They are implementing some strategies such as mergers and acquisitions and new product development. A U.S-based company called CommScope, which have launched a coexistence portfolio to upgrade their passive optical network to increase their data speed and provide additional services and solutions without having to replace or add fiber to their existing passive optical infrastructure. In 2021, an India-based internet service provider called AirFiber Networks, which have launched data services by using Gigabit Passive Optical Networking. In addition, Nokia is providing GPON solutions to AirFiber, which would enable high-speed broadband services in Bangalore and underpenetrated areas across the Tamil Nadu state. Additionally, they are focusing on reaching over 100,000 subscribers per year. Moreover, the Nokia Telecommunications Company has launched 5G passive optical network technology to enable the converging of high-end solutions on single fiber infrastructure. Besides these new launches, the demand for green network solutions is estimated to drive the growth of the Indian passive optical network market throughout the upcoming years from 2022 to 2032.

According to the study, key players such as Adtran Inc (U.S), Alphion Corporation (U.S), Adva Telecommunications (Germany), Broadcom Inc (U.S), Calix Inc (U.S), CommScope (U.S), Cisco Systems Inc (U.S), Ciena Telecommunications (U.S), DZS Telecommunications (U.S), Ericsson Telecommunications (Sweden), Fujikura (Japan), Furukawa Group (Japan), Huawei Technologies (China), Hitachi Limited (Japan), InCoax Networks (Sweden), Mitsubishi Electronics (Japan), Marlin Equity Partners LLC (U.S), Motorola Solutions (U.S), NXP Semiconductors (Netherlands), TP-Link Technologies (China), TE Connectivity (Switzerland), Ubiquoss Communications (South Korea), Nokia Telecommunications (Finland), Qualcomm Inc (U.S), ZTE Corporation (China), among others.

Scope of the Report:

|

Report Coverage |

Details |

| Market Size in 2021 | US$ 7.5 Billion |

| Market Volume Projection by 2032 | US$ 56.4 Billion |

| Forecast Period 2022 to 2032 CAGR | 19.80% |

| Base Year: | 2021 |

| Historical Data | 2019, 2020 and 2021 |

| Forecast Period | 2022 to 2032 |

| Segments covered |

By Component Type: ONT,OLT By Structure Type: GPON, EPON, WDM-PON By Application Type: FTTx, Mobile Backhaul |

| Geographies covered |

India China Japan South Korea North Korea Rest of Asian Countries |

| Companies covered | Adtran Inc (U.S), Alphion Corporation (U.S), Adva Telecommunications (Germany), Broadcom Inc (U.S), Calix Inc (U.S), CommScope (U.S), Cisco Systems Inc (U.S), Ciena Telecommunications (U.S), DZS Telecommunications (U.S), Ericsson Telecommunications (Sweden), Fujikura (Japan), Furukawa Group (Japan), Huawei Technologies (China), Hitachi Limited (Japan), InCoax Networks (Sweden), Mitsubishi Electronics (Japan), Marlin Equity Partners LLC (U.S), Motorola Solutions (U.S), NXP Semiconductors (Netherlands), TP-Link Technologies (China), TE Connectivity (Switzerland), Ubiquoss Communications (South Korea), Nokia Telecommunications (Finland), Qualcomm Inc (U.S), ZTE Corporation (China), among others. |

The India Passive Optical Network Market Has Been Segmented Into:

The India Passive Optical Network Market – By Component Type:

- ONT

- OLT

The India Passive Optical Network Market – By Structure Type:

- GPON

- EPON

- WDM-PON

The India Passive Optical Network Market –By Application Type:

- FTTx

- Mobile Backhaul

The India Passive Optical Network Market – By Regional Outlook:

Asia-Pacific

- India

- China

- Japan

- South Korea

- North Korea

- Rest of Asian Countries

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing