Mobile Money Market, (By Transaction Type: Point of Sale, Mobile Applications, QR Codes. By Payment Type: Person to Person, Person to Business, and Business to Person, business to business. By Mobile Application Type: Bill Payment, Money Transfers, Travel and Tickets, BSFI, Merchandise and Coupons. By Region - North America, Europe, Asia Pacific, and LAMEA) - Global Market Insights, Analysis, Growth, Trends, and Forecast 2022-2032

Report Type : Syndicate Report

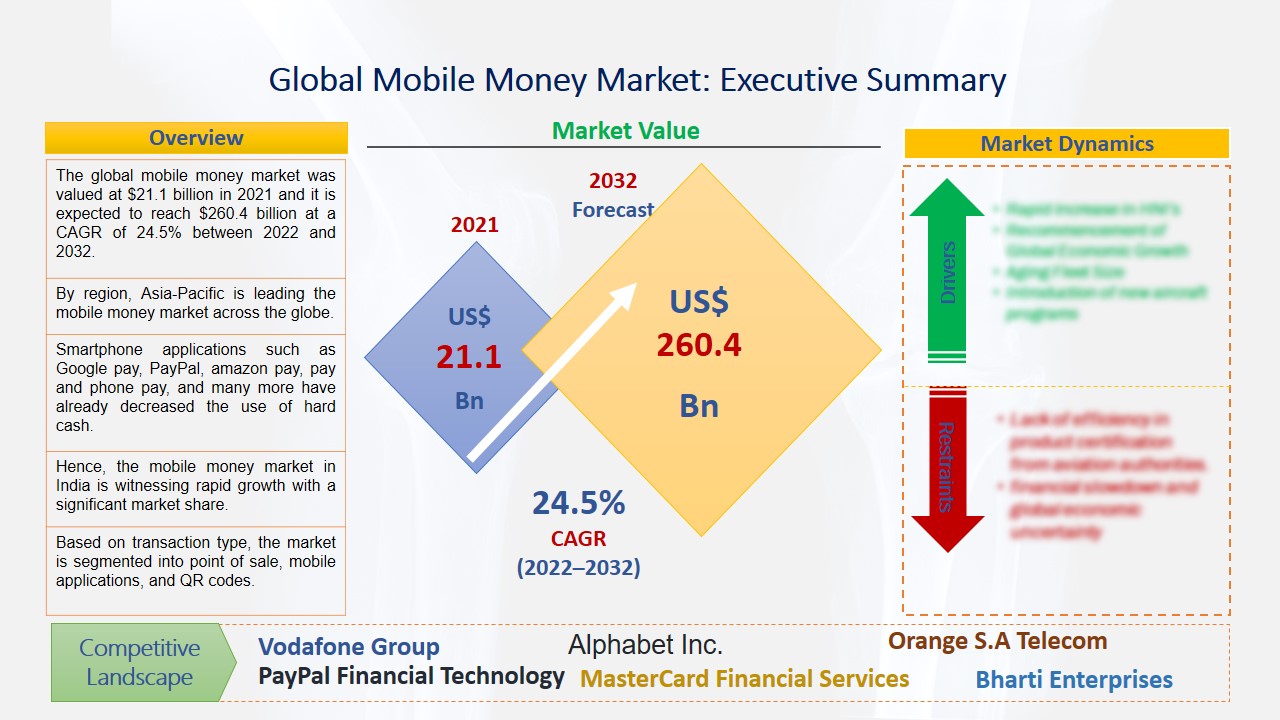

The global mobile money market was valued at $21.1 billion in 2021 and it is expected to reach $260.4 billion at a CAGR of 24.5% between 2022 and 2032. Mobile money is a type of online payment process, through which people can save, send and receive a certain amount of money by an electric or digital transaction. With the introduction of mobile money, the world has shifted to virtual money transfer procedures. Therefore, in modern days, people can transfer and receive a particular amount of money with just a few clicks.

By region, Asia-Pacific is leading the mobile money market across the globe.

At present days, digital transaction has supported worldwide consumers to pay online bills, buy many staffs, and receive person-to-person money, which comes very handy. There are other major factors such as the development of software and money transfer applications, among others are expected to drive the growth of the market throughout the forecast period. Smartphone applications such as Google pay, PayPal, amazon pay, pay and phone pay, and many more have already decreased the use of hard cash. These factors are also estimated to propel the market growth during the forecast period from 2022 to 2032. In the Asia-Pacific region, India has 16 mobile wallet applications, out of which 14 are Indian-based mobile wallet companies. Hence, the mobile money market in India is witnessing rapid growth with a significant market share. Similarly, China is also witnessing the largest growth in online payment services over the last few years. These are expected to drive market growth across the region.

Source: SAI Research

Based on transaction type, the market is segmented into point of sale, mobile applications, and QR codes. The mobile applications and point of sale are expected to propel this segment due to the number of applications that various companies are offering to their worldwide consumers. Based on payment type, the market is segmented into person to person, person to business, business to person, and business to business. All these categories are expected to drive the transaction type segmentation due to the increasing adoption of online payment applications in various industries, and business organizations. Worldwide customers are using many apps for a person-to-person payment, which have been driven the market growth over the last few years.

Based on mobile applications, the mobile money market is segmented into bill payment, money transfers, travel and ticket facilities, merchandise, and coupons. BFSI and travel segments are estimated to be the fastest-growing applications for the mobile money market across the globe due to the increasing usage of various apps from companies, which have driven the growth of the mobile money market. Geographically, the global mobile money market is categorized into North America, Europe, Asia-Pacific, Latin America, Africa, and the Middle East Countries. Among these, Asia-Pacific is leading the market over the last few years and the region is expected to drive the market growth throughout the forecast period. In India, there are several companies such as Yatra, MakeMyTrip, Ibibo, Cleartrip, and RedBus, that are providing online travel booking facilities, which would support the growth opportunities for the mobile money market. The adoption of various online payment applications due to increasing sales of smartphones in this region is projected to witness the largest growth during the forecast period. North America has also become the most lucrative region for the mobile money market which has displayed harmony over the past few years in adopting new and advanced technologies regarding smart phones and digital payment options. Furthermore, various major market players such as PayPal Holdings Inc and Microsoft Corporation, which are situated in this region, are supporting the market to gain significant growth opportunities in upcoming years.

According to the study, key players such as Vodafone Group Telecommunications Company (U.K), Alphabet Inc Multinational Conglomerate Company (U.S), Orange S.A Telecom Company (France), FIS Corporation (U.S), PayPal Financial Technology Company (U.S), MasterCard Financial Services Company (U.S), Fiserv Company (U.S), Bharti Enterprises Multinational Conglomerate Company (India), Thales Group Aerospace Company (France), Alipay Company (China), MTN Group Mobile Telecommunication Company (South Africa), Samsung Group Multinational Conglomerate Company (South Korea), VISA Financial Services Company (U.S), Tencent Multinational Conglomerate Company (China), Global Payments Company (U.S), Block Financial Services Company (U.S), Amazon E-Commerce Company (U.S), Apple Technology Company (U.S), Western Union Financial Services Company (U.S), Mahindra Group Multinational Conglomerate Company (India), Deutsche Telekom Telecommunication Company (Germany), Ant Group Company (China), UnionPay Financial Company (China), Rakuten Electric Commerce Company (Japan), One97 Communications Company (India), among others are leading the global mobile money market.

Scope of the Report:

| Report Coverage | Details |

| Market Size in 2021 | US$ 21.1 Billion |

| Market Volume Projection by 2032 | US$ 260.4 Billion |

| Forecast Period 2022 to 2032 CAGR | 24.5% |

| Base Year: | 2021 |

| Historical Data | 2019, 2020 and 2021 |

| Forecast Period | 2022 to 2032 |

| Segments covered |

By Transaction Type: Point of Sale, Mobile Applications, QR Codes By Payment Type: Person to Person, Person to Business, Business to Person, Business to Business By Mobile Application Type: Bill Payment, Money Transfers, Travel and Tickets, BSFI, Merchandise and Coupons |

| Geographies covered |

North America, Europe , Asia-Pacific , LAMEA |

| Companies covered | Vodafone Group Telecommunications Company (U.K), Alphabet Inc Multinational Conglomerate Company (U.S), Orange S.A Telecom Company (France), FIS Corporation (U.S), PayPal Financial Technology Company (U.S), MasterCard Financial Services Company (U.S), Fiserv Company (U.S), Bharti Enterprises Multinational Conglomerate Company (India), Thales Group Aerospace Company (France), Alipay Company (China), MTN Group Mobile Telecommunication Company (South Africa), Samsung Group Multinational Conglomerate Company (South Korea), VISA Financial Services Company (U.S), Tencent Multinational Conglomerate Company (China), Global Payments Company (U.S), Block Financial Services Company (U.S), Amazon E-Commerce Company (U.S), Apple Technology Company (U.S), Western Union Financial Services Company (U.S), Mahindra Group Multinational Conglomerate Company (India), Deutsche Telekom Telecommunication Company (Germany), Ant Group Company (China), UnionPay Financial Company (China), Rakuten Electric Commerce Company (Japan), One97 Communications Company (India), among others |

The Global Mobile Money Market Has Been Segmented Into:

The Global Mobile Money Market – By Transaction Type:

- Point of Sale

- Mobile Applications

- QR Codes

The Global Mobile Money Market – By Payment Type:

- Person to Person

- Person to Business

- Business to Person

- Business to Business

The Global Mobile Money Market –By Mobile Application Type:

- Bill Payment

- Money Transfers

- Travel and Tickets

- BSFI

- Merchandise and Coupons

The Global Mobile Money Market – By Regions:

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe Countries

Asia-Pacific

- India

- China

- Japan

- South Korea

- North Korea

- Rest of Asian Countries

LAMEA

- Brazil

- Saudi Arabia

- Rest of LAMEA

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing